See it in action

Watch how it works in real time. Enter a name, run a check, and review linked sources in seconds.

Monitor negative news about people and companies — in real time, in any language. KYCAID scores every hit for relevance and sentiment, reducing noise and surfacing true risks for faster AML decisions.

value from reputation

true positives detected

FTEs worth of labor freed

KYCAID streamlines your compliance checks with ID verification and Automated Adverse Media Checks all in one place. Add KYCAID to your AML screening process to pull information from identity documents and automatically cross-check it against global media and watchlists in real time.

We use more than keyword matching to analyze articles. Every piece of media is scored for both sentiment and relevance so you can instantly see if it’s really about your subject — and how serious it is.

Stay on top of things with real-time and continuous screening, not just one-time checks.

Keep your costs down with our easy pay-per-check pricing.

1 step

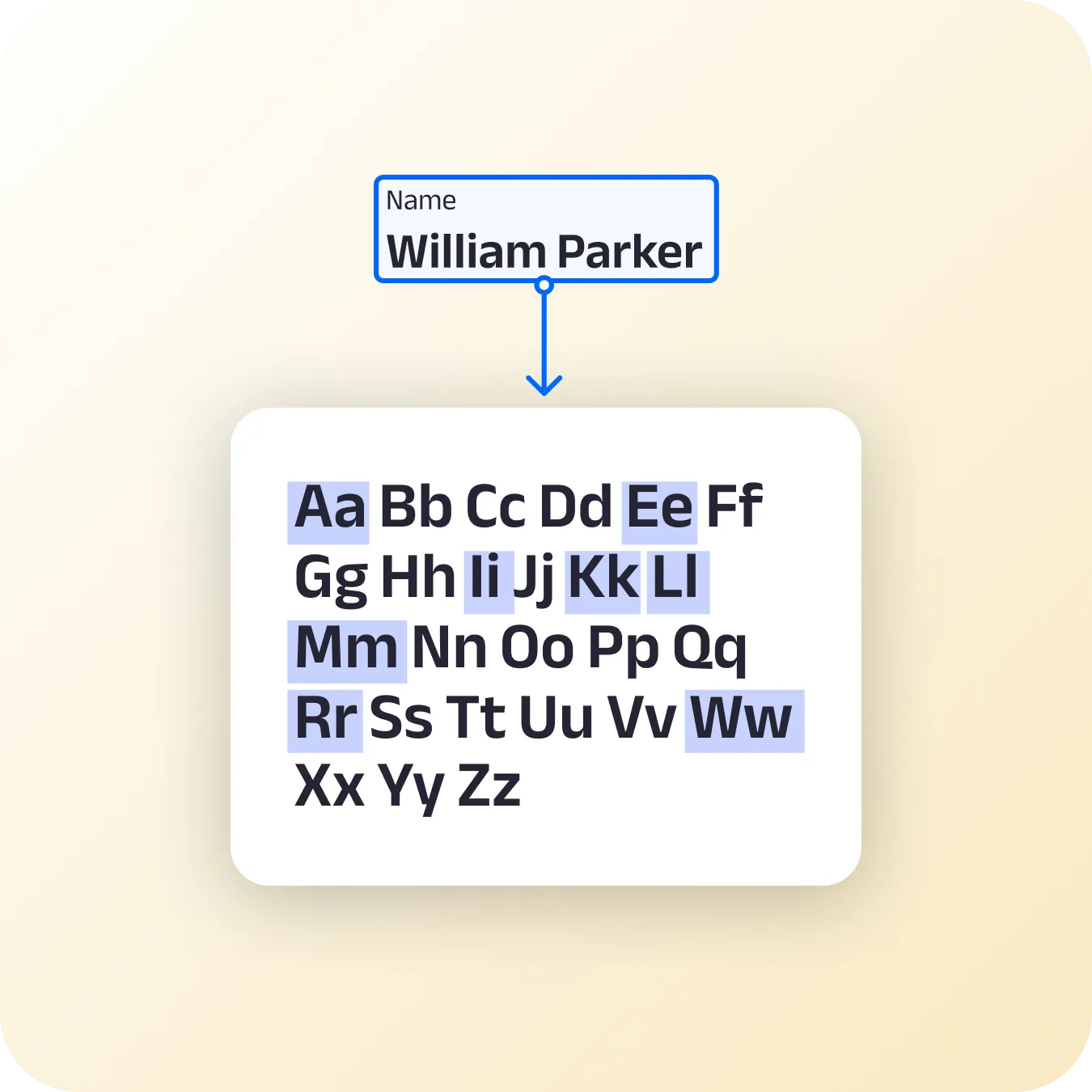

Data retrieval from the document, Manual search request in the Dashboard, or API Request.

2 step

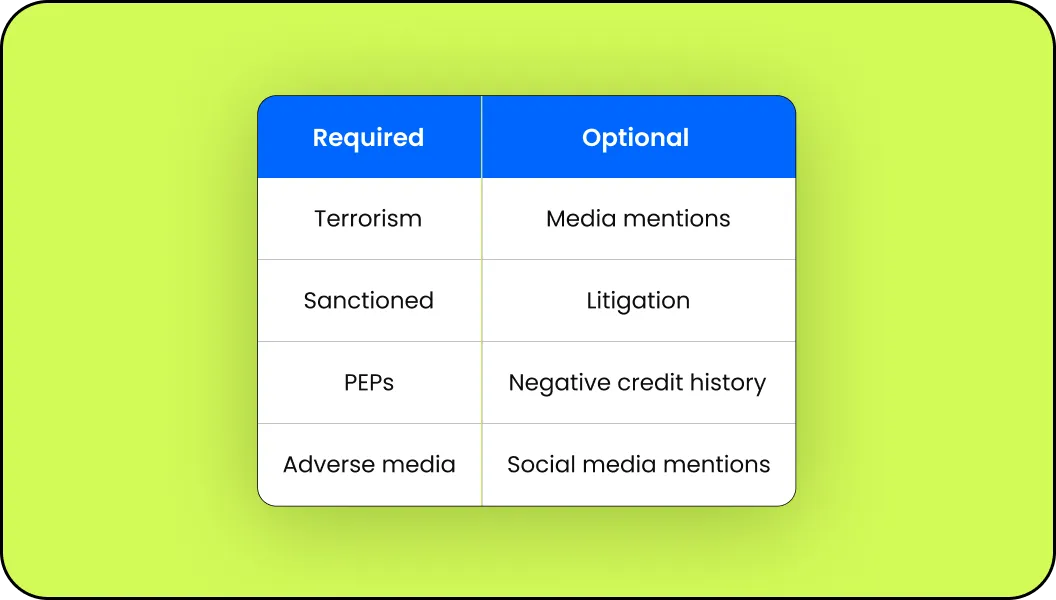

Required and Optional keywords settings.

3 step

Get your comprehensive report.

We use phonetic and fuzzy logic to reduce false negatives and identify near matches. Our API ensures you find what matters even when names are transliterated or misspelled.

KYCAID converts unstructured media articles into structured intelligence through natural language processing. Automatically extract key topics, entities, and themes from dense text data.

Each result comes with a sentiment score and a relevance indicator, so your compliance team can quickly determine the severity of results with no manual parsing or interpretation needed.

Our system aggregates mentions from multiple sources into a single, clean report, so you get the full picture without toggling between tabs.

Choose KYCAID to simplify compliance and optimize AML costs with a solution designed around your needs:

The definition is publicly available information (news articles, blog posts, reports, etc.) that associates a person or entity with suspicious or potentially illegal activity. This can include mentions of fraud, corruption, money laundering, terrorism, criminal activity, or other risk indicators.

The definition is a screening process that searches for negative news about individuals or companies in order to identify reputational and compliance risks. It is a part of customer due diligence (CDD) process that may identify risks not found on official watchlists.

The definition is a score that indicates how well a media article matches the keywords and context of your search query. Scores closer to 1.0 indicate content more relevant to the person or entity being screened and may suggest a higher potential risk, while lower scores indicate weaker or more indirect matches.

The definition is any credible media or data that associates a person or organization with illegal or unethical activity. In Anti-Money Laundering (AML) programs, such information can be used to support risk assessments and make decisions about onboarding, monitoring, or escalation.

Try out our services

Please provide your corporate email address before you start

By submitting this form, you confirm that you have read and understand KYCAID's Privacy Policy