KYC Verification for Law Firms & Solicitors

Simplify and streamline client onboarding with KYCAID's fast, reliable KYC solutions. Empower your law firm with cutting-edge tools for effortless regulatory compliance.

KYC & AML Checks

for Legal Entities

Enhance compliance for your legal entity with automated KYC services. Streamline onboarding, mitigate risks, and ensure regulatory adherence through cutting-edge tools. Risks can impact any professional field, both internally and externally. In legal, as in finance and real estate, effective risk management, and adherence to KYC & AML policies are crucial.

Law firms are increasingly targeted by financial fraudsters and cybercriminals seeking to exploit client data and infiltrate networks. To ensure smooth operations and business continuity, implement robust risk management measures and adhere to defined regulations.

Law Firms

AML Compliance

AML and KYC compliance for law professionals involves implementing procedures to verify client identities, assess risks, and prevent illicit financial activities. Elevate your due diligence, documentation, and ongoing monitoring ensuring integrity, trust, and legal standing in the financial landscape with our compliance expertise.

Key Weaknesses in KYC & AML Practices

-

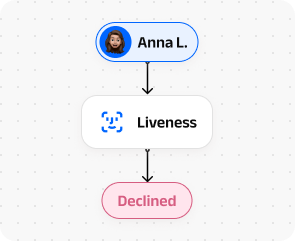

Insufficient Due Diligence

Certain law firms might perform insufficient due diligence during client onboarding, leaving loopholes in identity verification and background screening, which can be exploited by fraudsters.

-

Lack of Staff Training

Lack of comprehensive training on AML and KYC procedures for legal professionals can lead to oversight and misinterpretation of regulatory requirements, creating vulnerabilities for fraudsters to exploit.

-

Ineffective Monitoring Systems

Law firms may lack robust systems for continuous monitoring of databases' appearance. This can fail to detect suspicious patterns, allowing fraudulent activities to go unnoticed.

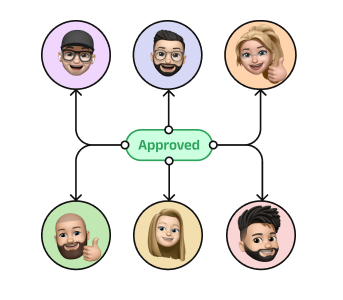

Build trust, stay legally compliant with KYCAID

Discover how our AML and KYC compliance solutions can safeguard your law practice. From verifying clients identities to ensuring regulatory adherence, streamline your procedures with us.

Fighting Money Laundering Crimes with KYCAID

Ensure secure financial practices with KYCAID for law firms in the fight against money laundering crimes. Establishing a robust AML program is essential for presenting reliable financial activity. Our solution aligns with FATF and EU regulations, safeguarding against money laundering, terrorism financing, and threats to financial integrity.