KYC & AML Solutions

for Insurance Companies

Transform your insurance business with KYCAID’s advanced KYC & AML solutions, ensuring superior security and seamless compliance tailored specifically for insurance companies.

KYC & AML: Essential for

KYC For Insurance Regulators

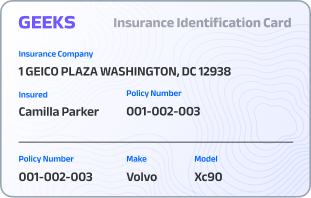

Given their substantial disbursements, ownership transfers, and diverse schemes, insurance services become susceptible to money laundering. Challenges include illicit fund laundering, fraudulent claims, fake maturity benefits, car insurance scams, and fund diversion.

Mandatory for financial institutions, KYC verifications ensure legal compliance, tax adherence, and fraud prevention. Additionally, KYC safeguards customers by confirming insurance payouts reach genuine policyholders or their beneficiaries, enhancing overall security.

Types of Fraud

in Insurance Sector

Experience our global reach: operating in 200+ countries and territories with expertise in verifying over 10,000 document types . Our solutions ensure safety and reliability at every step.

The Future of Digital Insurance

As a part of the AML regulations system, KYC guards insurance firms and other financial entities from money laundering and crime. This process generally comprises four different components:

-

Customer acceptance processes

-

Customer identification policies

-

Tracking transactions

-

Risk management

Automated KYC solution for insurance business

KYCAID develops automated omnichannel solutions for ultimate verification, which can take a huge workload off insurers’ shoulders. Our software works quickly, accurately, and cost-efficiently. It reliably guards you against fraudulent activities, thereby limiting financial losses.