all-in-one compliance platform

Industry Leading

KYC Verification Solution

Unlock seamless onboarding with KYCAID Verification Software! Streamline customer verification processes, enhance security, and elevate user experience effortlessly. Try now and revolutionize your business!

Effortless KYC compliance

with advanced software solutions

-

Quality😎

Our in-house compliance system and expert legal professionals ensure exceptional outcomes.

-

Security👮

We uphold the highest industry security standards, validated by ISO certification and routine security audits.

-

Velocity🚀

Immediate document and selfie verification with the industry's best SLA for manual checks.

Government checks

Verify with just an ID or Personal number, or through a tap on a bank or government app. Already available in 5 countries, including the Brazil, Mexico, Kazakhstan with more coming soon.

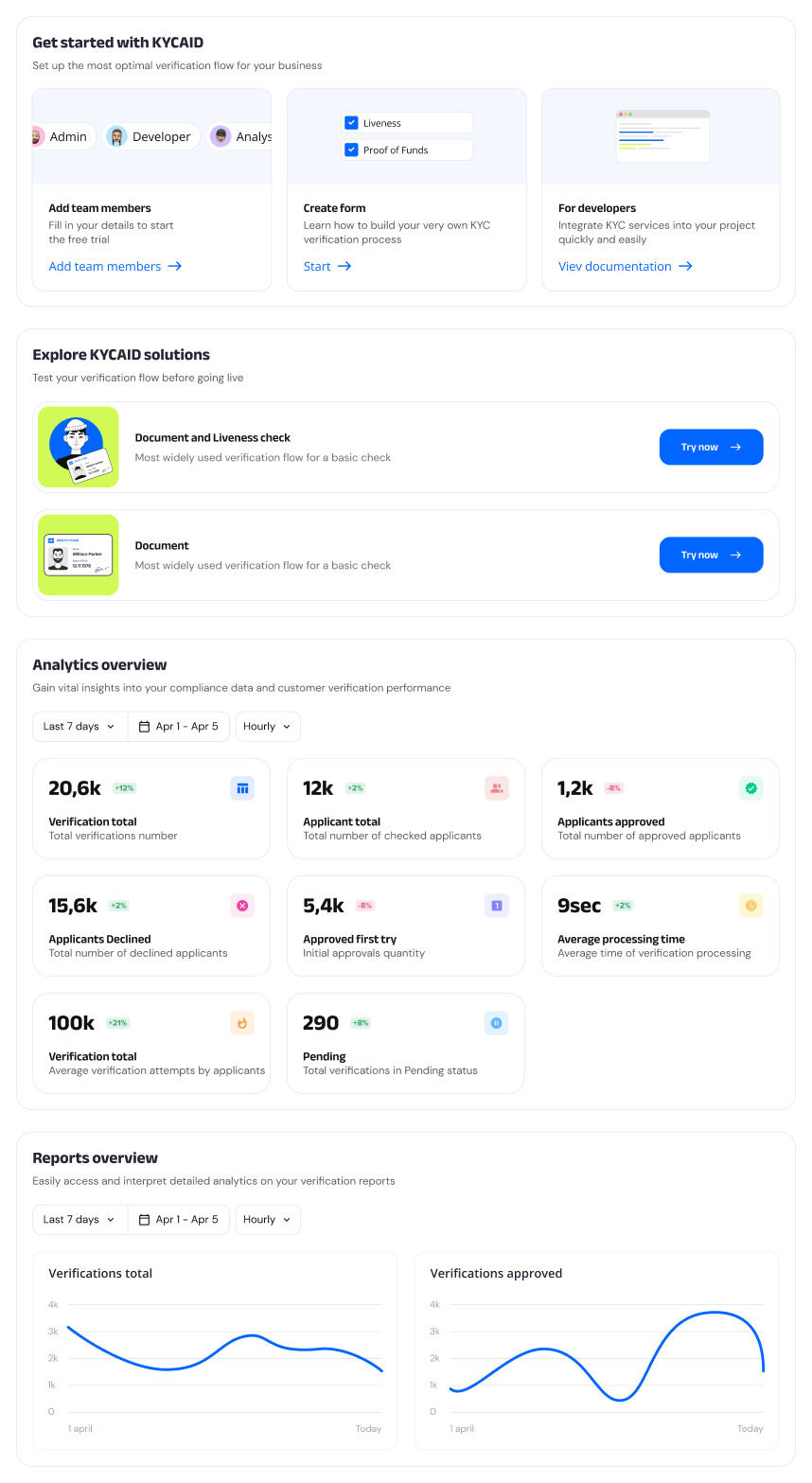

Try our solutionAgile KYC Verification Services

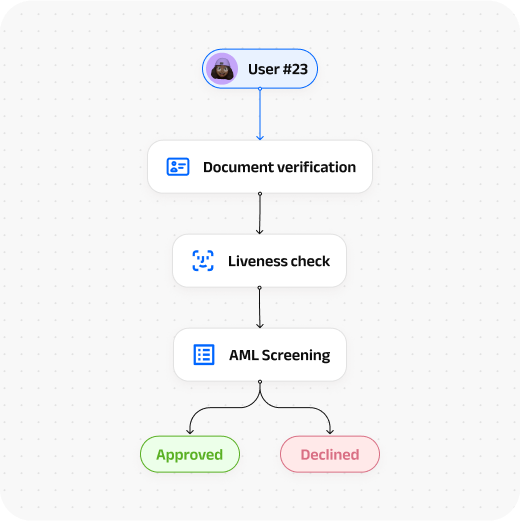

Manage all your identity verification requirements effortlessly from one convenient dashboard. Whether it's verifying users, or businesses, our platform lets you handle it all while efficiently managing cases and preventing fraud.

📋Streamlined KYC Checks

Our online platform helps with customer identity verification without the need for in-person visits. With real-time access and full automation, businesses can streamline processes and reduce risks while minimizing manual data handling. Affordable KYC checks utilize multiple global and local databases, significantly shortening the processing time to 20 sec. Any potential risk associated with a particular individual detection triggers prompt user notification, ensuring a proactive approach.

Compliance with KYC & AML regulations is crucial in reducing the company's risk exposure. This legal obligation serves as a shield for your business against potential fraud.

KYCAID solution stands out for speed and accuracy in the verification of an individual's identity, reliability and criminal history. Learn more about our services!

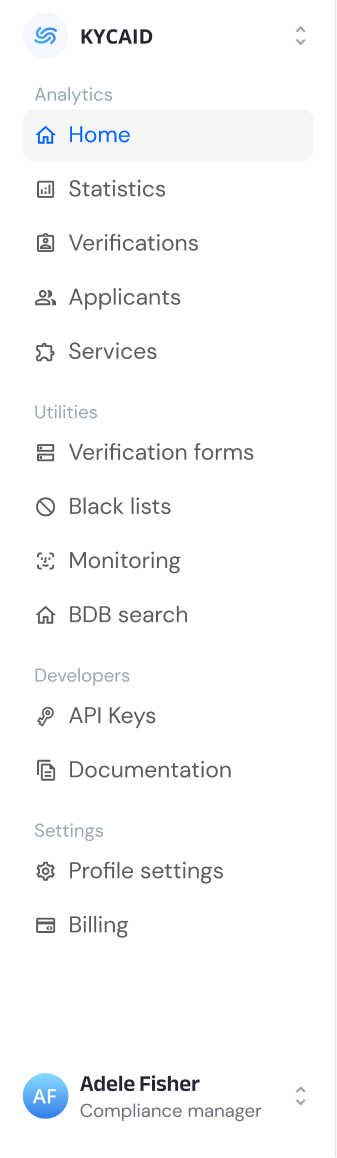

Simplified Integration of KYC Authentication API

KYCAID’s platform offers various methods in a single integration point. There are 3 integration ways: using pure API integration, Forms integration and Mobile SDK

| 1 | |

| 2 | "applicant_id": 'applicant_id', |

| 3 | "type": "PERSON", |

| 4 | "first_name": "John", |

| 5 | "middle_name": null, |

| 6 | "last_name": "Doe", |

| 7 | "dob": "1970-10-25", |

| 8 | "residence_country": "GB", |

| 9 | "gender": null, |

| 10 | "email": "[email protected]", |

| 11 | "phone": null, |

| 12 | "pep": null, |

| 13 | "profile_status": false, |