Reliable KYC & AML Solution for fintechs

Seamlessly onboard your customers worldwide with KYCAID’s identity verification solutions. Ensure hassle-free 360 º identity verification for clients no matter where they are with our all-in-one platform.

KYC legal requirements

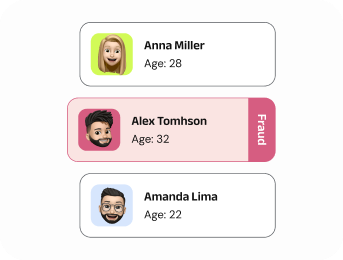

Harmonious blend of fraud deterrence, user-centricity, and compliance.

Set up your own rules for different flows and maximise success rates by implementing timely and appropriate verification checks.

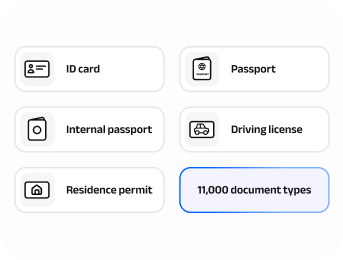

Global operations without barriers

Meet international standards in 200+ countries with our flexible solution, 11,000 document types, and instant data extraction. Achieve new markets while maintaining regulatory compliance wherever you operate.

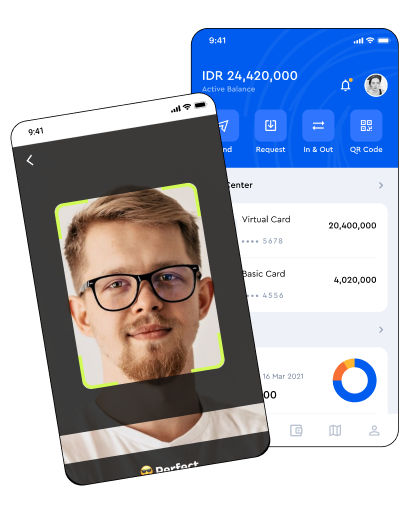

Improved Conversion

Enhance conversion rates by preventing customer drop-offs through fast, accurate, and user-friendly KYC verification.

Let’s talk numbers

-

15-sec

average check speed

-

100 +

companies trust us

-

200+

countries covered

Why Kycaid Stands Out in Fintech Cases?

-

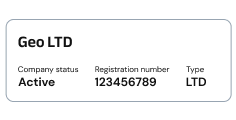

Payments

Streamline account opening with swift merchant KYB, automating client verification within hours for efficient payment operations.

-

Digital Banking

Maximise digital banking security and user satisfaction with robust identity verification, tailoring workflows for each user segment.

-

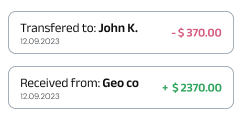

Payment Method Verification

Utilise straightforward processes to verify cards and bank statements, maintaining legitimacy and traceability of funds.

-

Crypto Asset Services

Maintain smooth, secure global verification for high pass rates and get to Know Your Client 360 º. Foster trust and security for a seamless user experience.

- Try now

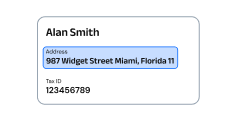

Lending

Enhance security and streamline customer onboarding with strong identity verification measures, enhancing security in your lending environment, ensuring regulatory compliance, and fostering trust with customers.

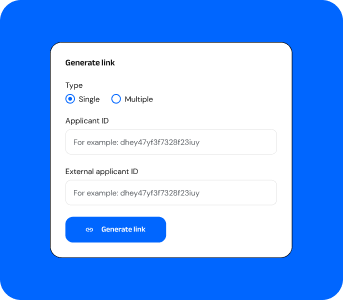

Generate the link with

just one click

Share a link with your customers and initiate verification in minutes—absolutely no coding necessary

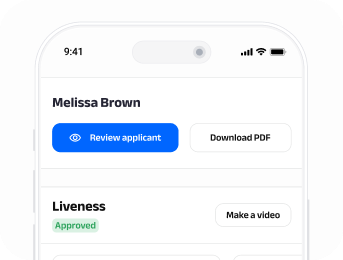

Next-Level Integration with Versatile SDKs

Easily integrate our iOS, Android and Web SDKs to assist in crafting an unparalleled user experience for your clientele.