Empower Mutual Funds:

KYC & AML Verification Solutions

Ensure the safety and integrity of the Investments through our seamless KYC & AML verification process.

Unlock the potential

of mutual fund investments with confidence

In any financial service or venture into mutual funds, KYC is crucial. We ensure a verified identity, promoting seamless compliance and safeguarding against unlawful activities.

Efficiency

Streamlined KYC procedures ensure quick onboarding, allowing you to start investing sooner. With a secured SLA time of 5 minutes for manual cross-checks you can count on swift and accurate verification.

Compliance

Stay ahead of regulatory requirements with our meticulous verification processes. Our certified compliance managers ensure adherence to industry standards.

Security

KYCAID employs industry-leading security protocols designed to protect personal information with the utmost care, ensuring it's handled with the highest standards of privacy and security.

Expertise

Benefit from our extensive experience in KYC, guaranteeing precise identity verification customized to the specific needs of mutual fund businesses. We excel at designing personalized verification procedures, offering comprehensive solutions that emphasize efficiency and compliance.

Begin the journey to secure investing today with KYCAID's online KYC service for mutual funds. Test out the solution to learn more!

Which documents are required for online mutual fund KYC?

To complete the online mutual fund KYC process, the applicant provides the following documents and undergoes the verification:

Identity Verification

Applicants submit ID documents such as ID cards, driver’s licenses, or passports to confirm their name and ensure compliance across 247 countries аnd territories by verifying nationality, name, and birth date.

Address Confirmation

Users provide address proof like utility bills or government documents. Our technology offers automatic data extraction, multilingual support, and manual verification for regulatory compliance.

Facial Recognition

Analyzing facial features, detecting age, matching photos with documents, and conducting passive or active liveness checks for precise identity verification.

Bank Card Verification

Ensuring efficiency and mitigating risks with rapid credit/debit card verification tailored for mutual funds.

SoF

Confirming the legitimacy of the source of funds used in transactions, ensuring compliance with regulatory requirements.

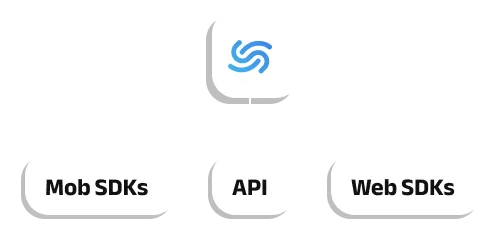

Learn more about hassle-free integration options

Easily integrate our Web SDK, IOS, Android and Forms to assist in crafting an unparalleled user experience for your customers.

powered by kycaid