Know Your Customer (KYC) and Anti-Money Laundering (AML) are often discussed together, yet the difference between AML and KYC is significant. Confusing the two can result in serious legal and operational consequences. This article explores what is AML, what is KYC, how they interact, and why distinguishing them matters in regulatory environments.

Anti-Money Laundering (AML) refers to the broader set of laws, rules, and practices designed to prevent financial crimes and illicit activities.Knowing Your Customer (KYC) is a specific method used within AML to assess and mitigate customer-related risks by verifying identity.Understanding KYC and AML compliance is essential for institutions seeking to operate legally and ethically in global financial markets.

The aftermath from AML and KYC misinterpretations

Mixing AML and KYC might result in:

Authorities applied penalties:In 2023, Binance paid $4.3 billion in fines with other financial institutions for violations of the Bank Secrecy Act and other anti-money-laundering rules.

Incorrect compliance strategies can affect customer experience and business operations, generating operational inefficiencies. These often stem from a poor understanding of KYC process vs AML policy, leading to gaps in implementation.

Know Your Customer, or KYC

By means of KYC—the process of client identification verification and risk profile assessment—one helps to prevent criminal or fraudulent behaviour. Usually it includes:

-Periodic changes to client data and transaction monitoring

-PEP and penalties screening, locating politically exposed people (PEPs) and sanction-listed people

-Face recognition plus biometric checks

Verification of official identification documents

The basis of a safe relationship, KYC is mostly used in the onboarding phase. Before clients may access services, the KYC onboarding procedure guarantees that they are who they claim to be. Regular updating of this material is also essential to preserve compliance and risk consciousness.

What is AML? Anti-Money Laundering

AML is the acronym for the mechanisms and rules meant to stop financial crimes generally. Important elements consist of:

-Following regional norms like the EU's AMLD and worldwide frameworks like the FATF

-Reporting suspicious activity (SARs) as needed

-Constant observation for red flags in client conduct

-Starting with strong KYC checks

Internal audits are also part of AML solutions for companies since they enable companies to assess the effectiveness of their compliance systems and draw attention to any weaknesses in reporting or detection.

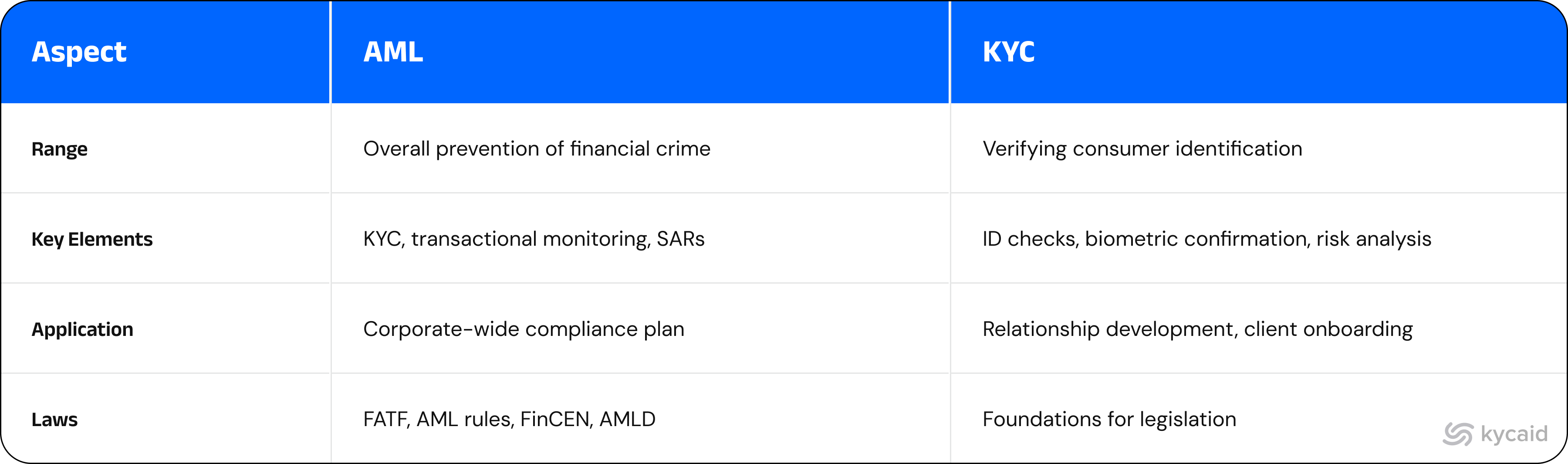

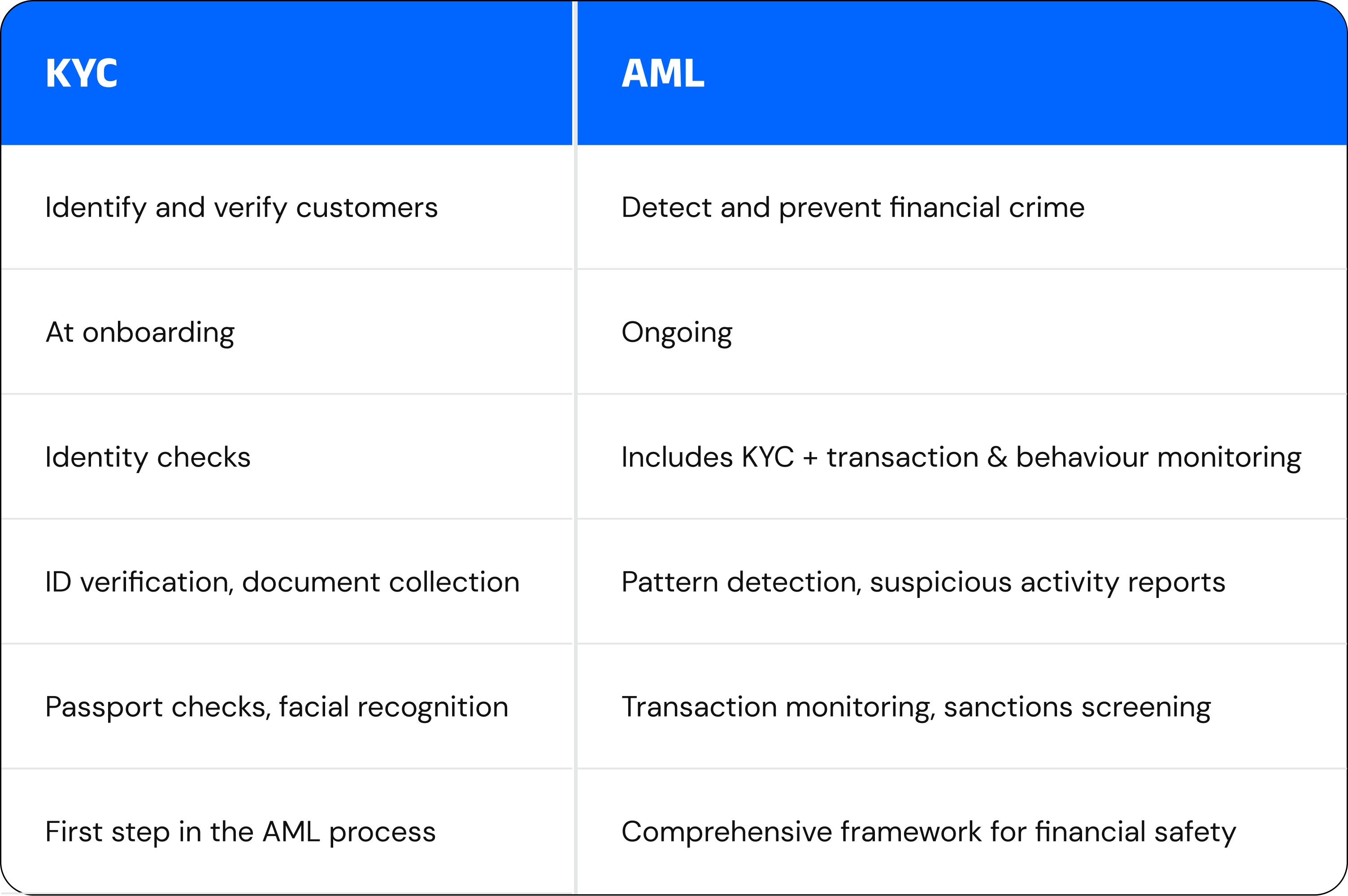

Key Differences Between AML and KYC

Knowing the differences between AML and KYC helps companies implement the correct actions at the correct moment, therefore enhancing compliance results.

Including KYC within AML Plans

AML projects start with KYC. Institutions can enhance their complete AML approach and enable improved transaction monitoring and anomaly detection by validating customer identities and evaluating risks upfront.KYC serves as the initial checkpoint — verifying who the customer is and evaluating potential risk. AML continues beyond this, providing continuous monitoring, behavioural analysis, and suspicious activity reporting to maintain compliance.

Value of AML and KYC

Applying robust AML and KYC rules:

- Ensures alignment with both local and international legal standards

- Strengthens reputation and builds trust with users and partners

- Detects and prevents financial crimes like fraud and money laundering

- Facilitates access to regulated markets by proving operational integrity

Robust compliance measures also support smoother expansion into regulated markets. Jurisdictions with strict financial laws often require evidence of effective KYC and AML compliance before allowing business entry.

KYC and AML Policies Specific to Industries

Each sector applies AML and KYC differently:

- Fintech and Neobanking: Require agile systems to manage fast-paced digital transactions and efficient KYC onboarding processes

- Cryptocurrency and Blockchain: Need stringent AML solutions for businesses to navigate evolving regulations

- Online Gambling and Gaming: Require identity checks and real-time monitoring to avoid fraud and underage use

- E-commerce: High-value transactions demand identity and risk verification

- Traditional Financial Institutions: Operate under stringent AML policies with continuous internal oversight.

Issues with AML and KYC Compliance

- Jurisdictional challenges: Differing rules across borders make standardisation difficult

- Balancing compliance with user experience: Thorough checks without creating friction

- Data protection and privacy: Compliance with regulations like GDPR is non-negotiable

- Scalability: As businesses grow, so must their compliance frameworks

These challenges underscore the need for intelligent, flexible AML solutions for businesses of all sizes.

Short Overview: Global KYC and AML Compliance

Europe

The European Union adopted the Sixth Anti-Money Laundering Directive (AMLD6) in order to strengthen its campaign against financing of terrorism and money laundering. It harmonises AML procedures among member states, therefore improving the EU's legal foundation.

Principal Needs:

- Customer due diligence (CDD) is something financial organisations have to do—that is, confirm client and beneficial owner identities.

- High-risk clients—including politically exposed persons (PEPs)—need enhanced due diligence (EDD).

- Real-time detection of suspicious transactions calls for transaction monitoring.

- When criminal conduct is uncovered, suspicious activity reports (SARs) have to be turned in to the authorities.

- AMLD6 also covers companies connected to cryptocurrencies, which calls for wallet providers and exchanges following KYC guidelines.

GDPR

Although not particular to KYC/AML, the General Data Protection Regulation (GDPR) significantly influences how personal data—especially sensitive consumer information gathered during KYC operations—is handled in the EU.

Important Prerequisites:

- Companies have to have express permission from people to gather and handle personal information, including KYC check related data.

- Minimise your data by just gathering required personal information.

- Companies have to provide the right to access and erasure of personal data as well as guard personal information from breaches.

- Compliance with GDPR and AML rules depends on customer data being securely kept and auditable for AML needs.

US: FinCEN and BSA

Enforcing AML rules across American financial institutions, FinCEN—the Financial Crimes Enforcement Network—is a branch of the U.S. Department of the Treasury.

Important Needs:

- Financial institutions have to set and keep AML policies including KYC processes to confirm customer identities.

- Detecting suspicious behaviour requires transaction monitoring; any unexpected transaction calls for SARs.

- Along with the individual consumers, FinCEN enforces adherence to the Customer Due Diligence (CDD) Rule, which calls for companies to find and confirm advantageous owners of legal entities.

- The pillar of the U.S. AML system is the 1970 enacted Bank Secrecy Act (BSA).

Important Conditions:

- Financial institutions have to keep records of their transactions and notify FinCEN of significant cash transactions (more than $10,000) and questionable behaviour.

- Financial institutions have to set up Customer Identification Programs (CIPs) to validate consumer identities inside the KYC process.

- BSA rules also involve wire transfer reporting and anti-money laundering initiatives, together with continuous staff training and outside audits.

Asia: MAS (Singapore) and FSA (Japan)

MAS (Singapore) is the central body in charge of supervising financial institutions in Singapore and implements rigorous AML/KYC guidelines.

Essential Needs:

- During the onboarding process, financial institutions have to do customer due diligence (CDD) and confirm client identities.

- The risk-based strategy insists that companies evaluate every client's possible risk and apply suitable degrees of examination.

- Institutions have to report suspicious transactions (STRs) upon discovery of such activity.

- Under the Payment Services Act (PSA), MAS has also included AML measures for virtual asset service providers (e.g., crypto exchanges), which must follow KYC rules.

Enforcing Japan's AML/KYC rules is the Financial Services Agency (FSA). These rules seek to bring Japan into line with global norms including recommendations of the Financial Action Task Force (FATF).

Essential Conditions:

- Every client of financial institutions has KYC checks to confirm identity and due diligence on their financial background.

- The degree of KYC investigation given to various clients is ascertained using the risk-based methodology.

- Detecting and documenting suspicious activity calls for transaction monitoring.

- Japan also lays strict rules on bitcoin exchanges that call for KYC procedures, transaction monitoring, and reporting of suspected activity to the authorities.

How can KYCAID help to support AML and KYC compliance?

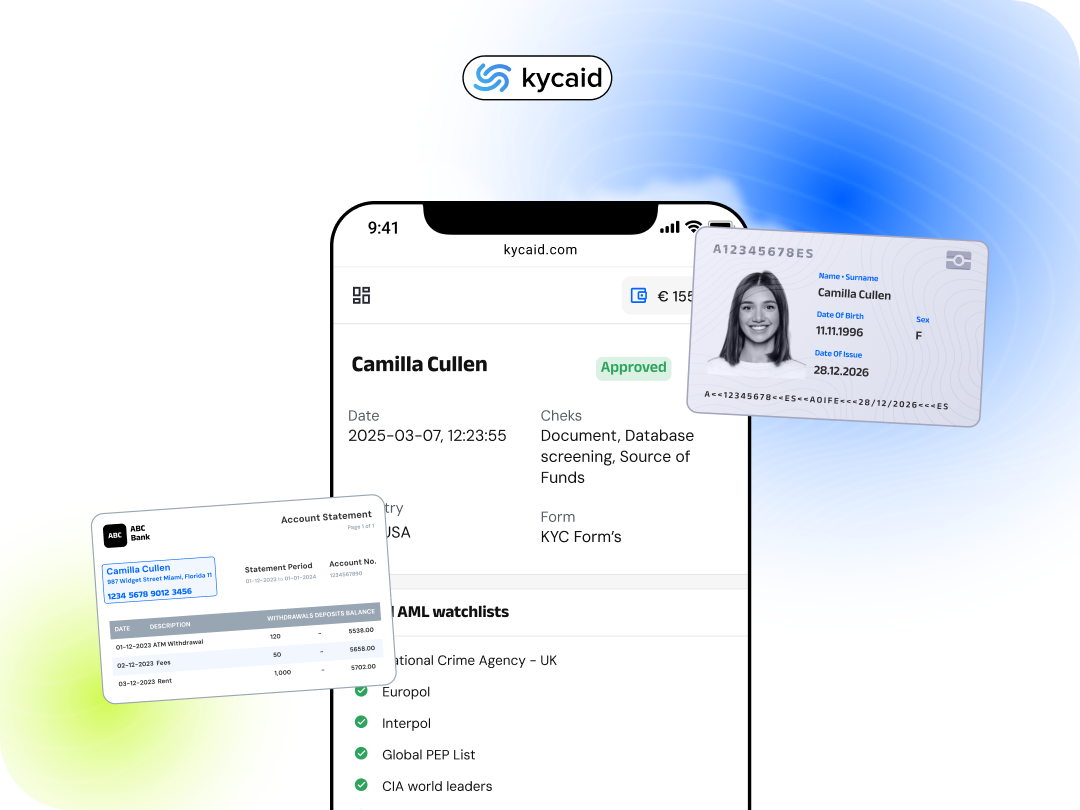

KYCAID provides smart tools designed to simplify KYC and AML compliance:

✅ Seamless customer onboarding – Quick ID verification and document checks

✅ Real-time monitoring & screening – Monitor document expirations and ensure compliance with global sanctions and PEP lists

✅ Customisable KYC rules – Set up your own automated verification workflows

✅ Global coverage – Access verification in over 200+ jurisdictions

✅ Regular compliance updates – Keep up-to-date with changing regulations

Good compliance requires a clear understanding of the difference between AML and KYC. KYC focuses on verifying customer identity during onboarding, while AML deals with broader financial crime prevention through continuous monitoring and reporting.In today’s regulatory landscape, aligning both strategies is not optional — it’s essential.