Digital Fraud Trends: An Overview

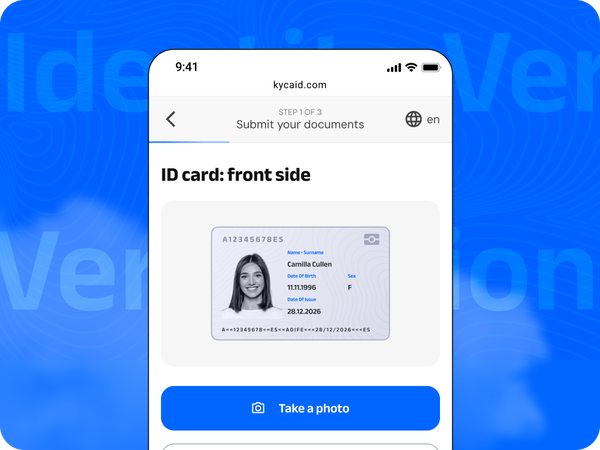

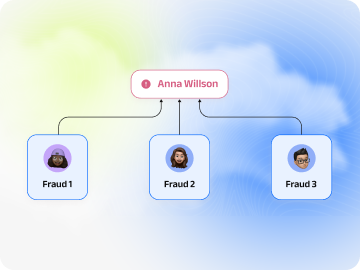

Discover the evolving landscape of digital fraud in today’s interconnected world. Our blog offers comprehensive insights into the latest trends, preventive strategies, and advanced solutions to fortify your business against cyber threats. Stay informed, stay secure.