The Allure of "No-KYC" Cards

In finance, convenience sells. From one-click payments to instant transfers, the race for speed rarely slows down. Now, a growing number of fintech companies are taking the next step: offering “no-KYC cards” — prepaid or virtual cards issued without customer verification.

The pitch sounds appealing: no forms, no documents, just a few taps to start spending. For users tired of bureaucratic red tape, it feels like freedom.

But removing identity checks doesn’t remove friction; it removes accountability. And history shows what happens when money moves faster than oversight can follow.

What "No-KYC" Really Means

Know Your Customer (KYC) is not a buzzword — it’s the foundation of secure finance. It ensures financial institutions verify who they’re dealing with, helping prevent fraud, terrorism financing, and money laundering.

A “no-KYC” card skips that process. The provider doesn’t confirm your identity, verify your documents, or screen against sanctions lists such as those maintained by the U.S. Office of Foreign Assets Control (OFAC) or the EU’s Consolidated Sanctions List.

Without those checks, anyone — including sanctioned entities or fraudsters — can move money freely.

It’s quick. It’s simple. It’s also the kind of gap that regulators and criminals both notice, though for opposite reasons.

The case for "No-KYC" cards

Finance is about convenience. No one would pay to buy groceries if they had to send a handwritten letter for each transaction. The industry continually races to make payments simpler and faster: 1-click checkout, real-time transfers, tap-to-pay, etc.

One logical step beyond instantaneous payments: “no-KYC cards.” These are prepaid or virtual cards issued to customers without verification of their identity. Fintechs are already offering these in increasing numbers.

The card business is especially competitive. To win customers, providers promise simple, digital account opening “without paperwork.” Instead of filling KYC forms or submitting documents, users simply tap an app to confirm their identity photo-style.

For fintechs and fintech apps, no-KYC cards are great from a marketing angle. They reduce wait times, churn, and onboarding costs. They also create stickier relationships with customers who might otherwise leave if locked out of their funds.

But, for users, this convenience can seem intoxicating. After waiting in line to sign up, more verification forms, account lockdowns, and “help us protect your funds” pop-ups, a no-KYC card feels like it lets you break free of the financial system.

Except it doesn’t. It just makes it harder for anyone to know what you’re doing, including, well, the card issuer. So if you really want a truly frictionless experience and no oversight, by all means: get a no-KYC card. Just know what you’re getting into.

Case Studies: The Wirecard Collapse & Synapse failure

In 2024, U.S. fintech infrastructure provider Synapse filed for bankruptcy, triggering one of the most chaotic fintech failures in recent memory. The company, which powered banking, payment, and card-issuing services for dozens of consumer apps, left over 100,000 customers temporarily cut off from their funds.

When Synapse’s systems shut down, partner apps — including digital banks and card programs — could no longer verify account balances or process withdrawals. According to The Independent, about $90 million in customer funds went missing or became inaccessible during the collapse (The Independent, May 2024).

Synapse had marketed itself as a compliance intermediary, performing KYC and risk checks for its client fintechs. But when those controls proved inconsistent across platforms, the entire ecosystem fractured. The company relied on partner banks and downstream apps to maintain their own records — yet no one could reconcile who owned what.

The Synapse incident didn’t involve direct fraud, but it exposed a similar weakness to those seen in earlier scandals: blurred accountability and incomplete KYC oversight across multiple intermediaries. When verification and fund ownership aren’t clearly tracked, even legitimate companies can crumble — leaving customers legally and financially stranded.

For card issuers offering simplified or “no-KYC” onboarding, Synapse stands as a contemporary cautionary tale. The problem isn’t just compliance failure — it’s the structural fragility that emerges when no one knows, or can prove, who the customer really is.

The warning signs aren’t new. Four years before Synapse, another fintech giant, Wirecard, showed how far weak oversight can spiral.

Once a European success story, Wirecard issued prepaid cards, processed online payments, and partnered with merchants worldwide. In 2020, it imploded after admitting that €1.9 billion it claimed to hold simply didn’t exist.

According to Financial Times investigations (FT), Wirecard relied heavily on third-party acquirers and offshore partners to onboard clients and perform KYC. The company rarely verified whether those customers were real.

When auditors finally demanded proof of funds, Wirecard couldn’t produce any. Within weeks, the company collapsed, executives were arrested, and investors lost billions (Reuters).

Wirecard’s failure was criminal; Synapse’s was operational. But both share the same DNA: misplaced trust, fragmented KYC responsibility, and a belief that growth matters more than governance.

Why KYC Exists in the First Place

It helps detect identity theft, protect against unauthorized transactions, and prevent criminal misuse of payment systems.

It’s also a legal requirement. The Financial Action Task Force (FATF) and regional laws such as the EU Anti-Money Laundering Directive (AMLD) mandate customer verification. Failure to comply can lead to blocked accounts, heavy fines, or criminal prosecution.

KYC protects users, too. When a verified account is compromised, the user can prove ownership and recover access. Without verification, the trail runs cold.

The Real Risks for Issuers

Card issuers that cut corners on KYC open the door to cascading risks:

↪Regulatory penalties: Authorities worldwide have issued record fines for AML/KYC violations — including over $10 billion globally in 2023, according to Finbold and Refinitiv data.

↪Network suspension: Visa and Mastercard require strict onboarding procedures. Any issuer without proper KYC may lose access.

↪Fraud liability: Unverified accounts are easy vehicles for chargebacks and criminal use.

↪Reputational damage: Once media headlines associate a firm with illicit activity, user trust evaporates — sometimes permanently.

As the BBC summarized after Wirecard’s collapse, “The scandal wasn’t just about missing money — it was about missing oversight”.

The Hidden Dangers for Users

For users, “no-KYC” cards feel liberating — until something goes wrong.

If your card is hacked or frozen, the issuer might not be able to prove who owns the account. If the company itself is shut down for violations, customer funds can be locked indefinitely.

Some offshore providers also hold client balances in third-party wallets with no clear insurance or guarantee. When those intermediaries vanish, so does the money.

A Europol report on fintech misuse notes that “anonymous payment instruments remain a preferred tool for organized crime” (Europol, 2023).

In short, anonymity protects no one except the people you don’t want handling your funds.

Lessons from Synapse and Wirecard

The two collapses tell the same story from different angles.

Wirecard showed what happens when deliberate deception meets absent verification. Synapse showed how even without intent to defraud, fragmented oversight can still paralyze an entire payment network.

Both demonstrate that “trust by delegation” — letting partners or third-party providers handle KYC — doesn’t absolve responsibility. Ultimately, the issuer is accountable, whether the failure is criminal or systemic.

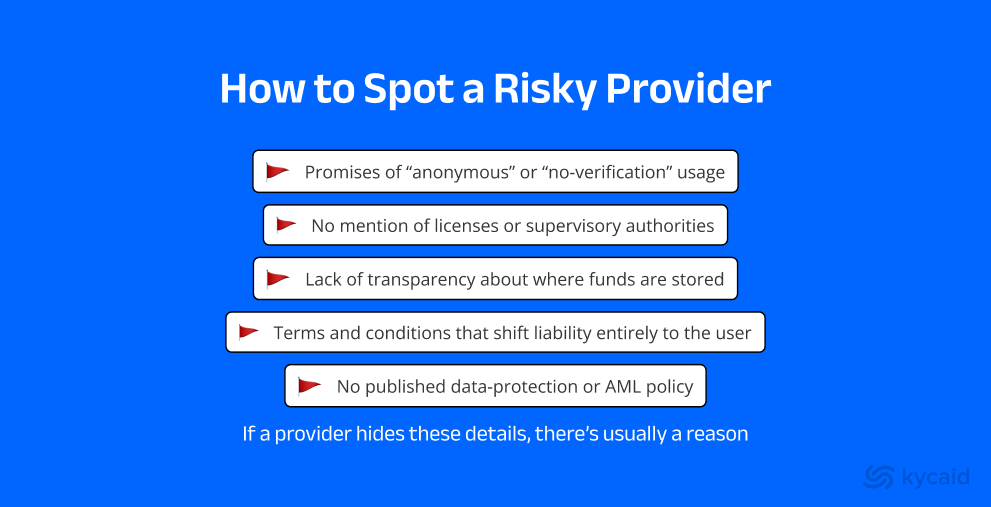

Why Some Firms Still Offer "No-KYC" Cards

The persistence of such products isn’t mysterious. It’s economics.

↪Marketing advantage: “Instant” sells better than “regulated.”

↪Lower cost: Full KYC systems require staff, APIs, and audit processes.

↪Legal grey zones: Some providers operate from lenient jurisdictions, counting on regulators’ slow reaction times.

But shortcuts rarely last. As seen with Wirecard and similar collapses, when scrutiny comes, it’s brutal and final.

Better Alternatives: Smarter KYC, Not More KYC

The goal isn’t to make KYC slower — it’s to make it smarter.

Modern compliance uses automation and data intelligence to reduce friction while staying within regulations. This is where platforms like KYCAID play a crucial role.

KYCAID provides end-to-end identity verification, document and biometric checks, and AML screening through a single API. It enables risk-based KYC, meaning customers are verified according to their risk profile — light checks for low-value users, deeper for high-risk cases. For issuers, that balance means staying compliant without punishing users with unnecessary steps.

In short, the technology now exists to make verification almost invisible — if businesses choose to use it.

The Future of Verification in Payments

Verification is undergoing its own quiet revolution. Machine learning models can now identify forged IDs, detect deepfake faces, and cross-reference applicants with hundreds of databases in seconds.

Regulators are adapting, too. The upcoming EU Anti-Money Laundering Regulation introduces stricter requirements for digital-only institutions, while the FATF’s “Travel Rule” is expanding beyond crypto to cover cross-border e-money transfers.

The trend is clear: the future of payments is faster and more transparent — but never anonymous. Smart KYC is not the enemy of innovation; it’s what allows innovation to survive regulatory scrutiny.

Speed Isn't Worth The Risk

“No-KYC” cards promise simplicity but deliver exposure. They invite the same pattern that toppled Wirecard — growth first, compliance later.

History shows that “later” often arrives as a criminal investigation or bankruptcy filing.

Whether you’re a fintech founder or a user, remember: verification isn’t bureaucracy. It’s the digital equivalent of trust.

And with modern tools — from AI-driven KYC platforms like KYCAID to global compliance frameworks — there’s no excuse to trade trust for convenience.

Speed fades quickly. Reputations don’t recover as easily.