Businesses and companies who run inside or interact with the US financial system must comply with OFAC screening. It helps to guarantee that entities are not conducting business with people or companies marked by the US government. This page defines OFAC screening, its importance, and who is responsible for conducting it.

Why Is OFAC Screening Important?

Part of the U.S. Department of the Treasury, the Office of Foreign Assets Control (OFAC) manages and applies trade and financial sanctions. Targeting certain people, organisations, and nations judged to endanger national security, foreign policy, or economic stability, these sanctions apply to.

Ignoring OFAC rules might lead to criminal prosecution and fines of multi-million dollars. Apart from legal hazards, companies also suffer operational interruptions and damage of reputation. By means of control, OFAC compliance checks guarantee companies remain compliant and minimises financial crime exposure by preventing transactions with sanctioned parties.

Companies That Need Customer Screening

Although financial institutions are main responsible for OFAC lists screening, various other industries also have to do screening including:

↪ Non-bank financial entities and banks

↪ Blockchain-based systems and cryptocurrency exchanges

↪ Legal advisers and consulting companies

↪ Operators in logistics, shipping, and goods freights

↪ Online markets and (in particular circumstances) freelancing sites

The commonality among these industries is their possible exposure to foreign transactions or parties situated outside the United States.

OFAC Screening: What Exactly Is It?

Legal Basis and Definition

OFAC screening is essentially the Specially Designated Nationals and Blocked Person List (SDN List) comparison of names of individuals, corporations, or vessels against the OFAC sanctions lists. Entities on these lists are either owned, managed by, or operate on behalf of sanctioned governments, terrorist groups, drug traffickers, or other targeted organisations.

Various U.S. legislation and executive orders—including the International Emergency Economic Powers Act (IEEPA), the Trading with the Enemy Act (TWEA), and particular country-based sanctions programs—formulate the legal foundation for OFAC compliance.

OFAC rules apply to every American, including citizens, permanent residents, companies formed here, and overseas branches.

When and Why Does It Need to Be Done?

OFAC screening is not a one-time activity. It has to be done:

↪ During onboarding, while building a new relationship with a client, supplier, or partner.

↪ During transactions, particularly cross-border payments, cryptocurrency exchanges, or high-risk activities.

↪ On an ongoing basis - sanctions lists are often updated; Companies must stay alert for any updates and conduct re-screening whenever required.

To understand which specific lists you're screening against, see our full breakdown of the OFAC sanctions lists.

Who Has to conduct OFAC Screening?

Economic Institutions

Of course, U.S. banks, credit unions, and other financial service providers are specifically mandated to conduct OFAC screening. This covers enquiries of account holders, wire transactions, and correspondent banking ties. Additionally expected is vice versa and U.S.-based subsidiaries of foreign financial organisations.

Platforms for Cryptocurrencies

In response to OFAC’s 2021 guidance on applying sanctions to digital assets, cryptocurrency exchanges and virtual asset service providers (VASPs) are required to implement robust sanctions compliance measures. These include screening customers, counterparties, and wallet addresses against OFAC’s sanctions lists. OFAC has also explicitly designated certain smart contracts and cryptocurrency wallets, highlighting the growing need for blockchain analytics tools and the ability to perform sanctions checks at the wallet address level.

Legal services, Shipping, and Logistics Companies

Legal service providers representing foreign customers or involved in cross-border transactions have to make sure their activities do not unintentionally involve sanctioned parties. Sanctions screening should be part of due diligence procedures both during client onboarding and deal structuring.

Companies engaged in international trade, shipping and logistics must screen boats, goods, and counterparties. OFAC has specifically approved ships and shipping companies, therefore this is a high-risk area needing constant compliance.

Limited Scope Markets and Freelancers

Online platforms enabling cross-border payments or escrow services must have screening systems even though individual freelancers are not usually held to the same requirements as controlled financial institutions. For instance, should no controls be in place, a U.S.-based freelance marketplace allowing payments to approved countries could be held accountable.

When dealing with U.S. clients or financial intermediaries, OFAC screening shows good corporate governance even in cases when regulatory criteria are less clear-cut.

How to conduct screening in the OFAC list

For companies doing business in or with the United States, Office of Foreign Assets Control (OFAC) screening is a vital compliance tool. The goal is to pinpoint people, businesses, and nations under economic sanctions. Ignoring these rules can lead to substantial financial penalties.

Step 1: Get Information

Begin by collecting identifying data. At a minimum, this includes:

🔹Full legal name

🔹Date of birth

🔹Country of citizenship or incorporation

🔹National ID or registration number (if available)

The more precise the data, the lower the risk of false positives later in the process.

Step 2: Match Against OFAC Lists

SDN list screening is a core component of OFAC compliance processes. However, screening should also include other OFAC lists, such as:

🔹Foreign Sanctions Evaders (FSE) List

🔹Sectoral Sanctions Identifications (SSI) List

🔹Non-SDN Lists

Include all relevant OFAC lists in the screening process.

Step 3: Address False Positives with a Risk-Based Approach

Most alerts will not be true matches. A risk-based approach involves:

🔹Prioritising exact matches on multiple data points

🔹Assigning risk scores based on geography, industry, or transaction type

🔹Escalating ambiguous cases for manual review

The goal is to reduce operational noise while maintaining compliance.

Step 4: Record Findings and Flag Matches

Each screening should generate a full audit trail, including:

🔹Date and time of screening

🔹Source of the data

🔹List and entry matched

🔹Resolution notes (e.g. “false positive – DOB mismatch”)

If a likely match is identified, freeze the transaction or relationship immediately and escalate for further review.

Step 5: Report to OFAC (If Required)

If a match is confirmed and falls under OFAC jurisdiction, reporting is mandatory. This generally includes:

🔹Blocking the assets or transaction

🔹Submitting a report via OFAC’s online system within ten business days

🔹Continuing periodic reporting until the issue is resolved

To understand which specific lists you are screening against, kindly refer to our comprehensive breakdown of the OFAC lists.

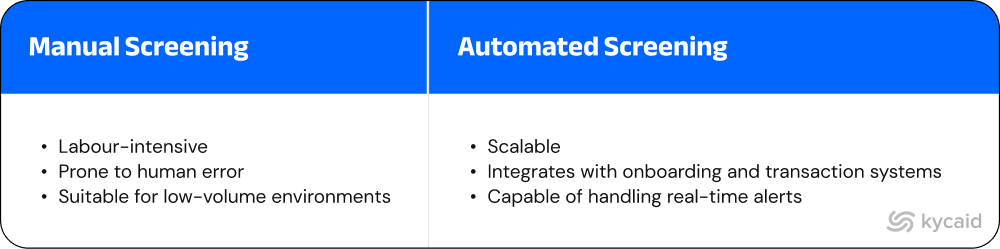

Manual vs Automated Screening

Manual Screening

🔹Labour-intensive

🔹Prone to human error

🔹Suitable for low-volume environments

Automated Screening

🔹Scalable

🔹Integrates with onboarding and transaction systems

🔹Capable of handling real-time alerts

Most companies require automation to meet compliance speed, volume, and audit requirements.

Role of APIs, Regtech Tools, and AI

Modern screening often relies on:

🔹APIs to connect internal systems with sanctions data

🔹Regtech tools for case management, real-time alerts, and reporting

🔹AI/ML models to detect risk patterns and reduce false positives

AI must be explainable and auditable to satisfy regulatory expectations.

Case Study: Fintech Startup

A digital wallet provider operating across multiple countries used an API-based screening solution. Integration with the onboarding system enabled real-time checks against OFAC lists. The system auto-flagged users with near matches and routed them for secondary review. A lean compliance team managed growing volumes efficiently.

Result: Scalable, low-friction compliance with minimal manual work.

Case Study: Traditional Bank

A regional bank initially relied on batch screening during account setup. After a regulatory review identified gaps in continuous monitoring, the bank implemented an automated screening system. It used machine learning to adjust risk scoring and built internal workflows for escalation.

Result: Over 72% reduction in false positives and successful subsequent compliance audits.

How Frequently Should One Screen? A Manual for Superior Compliance Monitoring

In the AML compliance process, screening and monitoring are key to reducing risk. Financial institutions have to strike a compromise between operational efficiency and the demand for constant monitoring. The issues and best practices for client screening, managing alerts, and preserving a compliant, risk-controlled workplace are discussed in this paper.

One-Time Versus Constant Surveillance

Whether to keep constant monitoring or do one-time screening is a major choice in every compliance program.

Usually part of the first client onboarding procedure is one-time screening. The client's identity should be confirmed and possible hazards at the point of entry evaluated. Although this is crucial, it does not consider any client changes in status over time. For this reason, long-term risk management cannot be adequately managed depending just on one-time screening.

Compliance with KYC and AML rules depends on constant, either periodic or continuous monitoring. Risk profiles of clients vary, hence constant screening helps to find red flags as they develop. Particularly in high-risk sectors or countries, regulatory criteria sometimes need regular screening to identify these changes.

Review Periodically

A pillar of constant observation is periodic reviews. Depending on the client's risk profile and legal obligations, these assessments range in frequency.

🔹Reviewing low-risk clients could happen once a year or twice a year.

🔹High-risk clients— politically exposed persons or from high-risk jurisdictions—may call for more frequent reviews.

Reviewing client data—such as changes in beneficial ownership, transaction patterns, and geographic exposure—should be part of periodic evaluations. Re-checking clients against sanction lists—including OFAC (Office of Foreign Assets Control) lists also is part of them.

When Should I Re-Screen Current Clients?

Re-screening current clients becomes essential when particular triggers or occurrences arise. These might be: Re-screening is justified if a customer changes important information such as their ownership or business structure.

🔹Regulatory updates: Should sanction list updates—such as those from OFAC—occur, clients should be re-screened to guarantee that no fresh warnings develop.

🔹Material changes in the client's activity: Re-screening may be required if suspicious changes in transaction volume or pattern suggest possible concerns.

🔹High-risk clients should, as discussed, be routinely assessed and re-screened, especially if their risk profile changes.

Handling OFAC Alerts and Matches

The KYC/AML process depends critically on OFAC screening. By screening customers against the OFAC Specially Designated Nationals (SDN) list, one can avoid conducting business with sanctioned companies and people.

Finding a match calls for determining if it is a false positive or a real match. The secret is to do extensive due diligence to confirm the match's identity.

Alert Handling: Alerts ought to be checked right away. Verifying the match, cross-referencing other databases, and grasping the whole background of the client's relationship with the entity are part of the inquiry process.

Should the alert prove to be a real match, it has to be escalated to the compliance team for additional action. This can cover both freezing assets and informing authorities.

Escalation System

Managing notifications suggesting possible compliance hazards depends on efficient escalation systems. Should an OFAC match be verified or another legal or regulatory matter develop, the escalation procedure usually proceeds in these ways:

① Compliance officer first looks at the type of the warning or match.

② Consultation: For more information, the subject is addressed with legal or outside professionals as necessary.

③ Based on the results, the compliance team chooses additional actions including freezing accounts or reporting to authorities.

This procedure guarantees that, in line with internal and legal criteria, all possible hazards are raised suitably and managed.

Handling False Positive Results

An often difficult problem in compliance screening is false positives. These arise when a client flagged for a sanction list match turns out not to be a match upon inquiry.

Institutions can employ sophisticated screening systems, guarantee their databases are current, and include cross-checks across several sanctions lists to help lower false positives.

Managing Alerts: False positives should be looked at closely to guarantee the right choice is taken. Though too many hand inspections might drain resources, it is crucial to strike a balance between efficiency and thoroughness.

By helping to prioritise warnings depending on the possibility of a real match, a risk-based strategy helps to simplify the investigative process.

When Should One Freeze Assets or Notify Authorities?

Generally reserved for when a real match is verified, freezing assets, notifying authorities marks a major milestone in the compliance process.

If a person or an entity is on a sanctions list, their assets could have to be frozen in order to follow laws. When a confirmed risk exists, this is a vital response.

Regarding suspected activities, the relevant authorities—such as law enforcement or the Financial Intelligence Unit (FIU)—should be informed. This stage guarantees that the authorities can look into more and implement required measures.

OFAC Screening Inside the Ecosystem of KYC/AML

Both KYC and AML systems rely critically on OFAC screening. The intention is to stop financial institutions from interacting with people or companies engaged in illicit activities including terrorism, money laundering, or other crimes. Including OFAC screening into the KYC procedure guarantees early identification of such hazards and appropriate action can be done.

Integration with the Onboarding Program

Screening has to be included into the customer onboarding process absolutely. Before developing any commercial relationship, screening should be done. Among other screening procedures, a careful OFAC check helps to guarantee compliance from the beginning. Early identification of concerns will help to avoid possible legal implications and future compliance difficulties.

Batch Screening and Client Lifecycle

Usually during regular reviews or when a new set of clients is onboarded, batch screening is executing a series of client checks against pertinent lists (e.g., OFAC, PEP lists) concurrently, usually. Additionally included within the client lifetime should be batch screening.

First screening during the onboarding process guarantees that new customers follow sanctions compliance.

Batch screening should be conducted often over the client's lifetime to find any changes in their risk level.

Final screening can assist to verify that no problems have developed during the business partnership if a client is leaving it.

Good compliance calls for proactive client monitoring and risk screening to help to avoid problems. Institutions should strike a mix between constant monitoring and occasional assessments and one-time screening upon onboarding. Best practices consist of:

🔹Routinely re-screening clients, particularly following changes in their data.

🔹Putting in place a competent alert and match escalation mechanism.

🔹Lowering false positives with sophisticated screening technology.

🔹Notifying authorities in case of verified sanction violations and fast freezing assets.

How KYCAID Facilitates OFAC Compliance

KYCAID provides a robust set of tools aimed at simplifying and reinforcing compliance with OFAC regulations. By leveraging automation, intelligent risk screening, and embedded controls, the platform helps organisations reduce the risk of engaging with sanctioned individuals or entities.

1. Live Sanctions Screening KYCAID conducts ongoing, real-time checks against key OFAC sanctions lists—including SDN, Non-SDN, SSI, and FSE—during onboarding and across the entire customer relationship. This ensures continuous alignment with the latest regulatory updates.

2. Intelligent Match Detection Using advanced algorithms, KYCAID can identify name variants, transliterations, and aliases that may otherwise evade detection in basic screenings.

3. Configurable Risk Processes The platform allows organisations to customise screening procedures to reflect internal risk tolerance and compliance protocols.

4. Embedded KYC and AML Integration Sanctions compliance is built into KYCAID’s broader identity verification and anti-money laundering infrastructure, enabling cohesive, end-to-end compliance checks.

5. Global Sanctions Support In addition to OFAC, KYCAID supports compliance with international sanctions frameworks, enabling consistent global screening standards.