In recent years, the financial landscape has experienced significant evolution, driven by advancements in technology, increasing regulatory demands, and the need for robust anti-money laundering (AML) and Know Your Customer (KYC) processes. These regulatory shifts continue to reshape industries such as gambling, financial services, and digital identity verification. To uphold trust, transparency, and security, businesses must stay agile and align with these evolving frameworks.

FATF’s Travel Regulation: A Comprehensive Compliance Approach

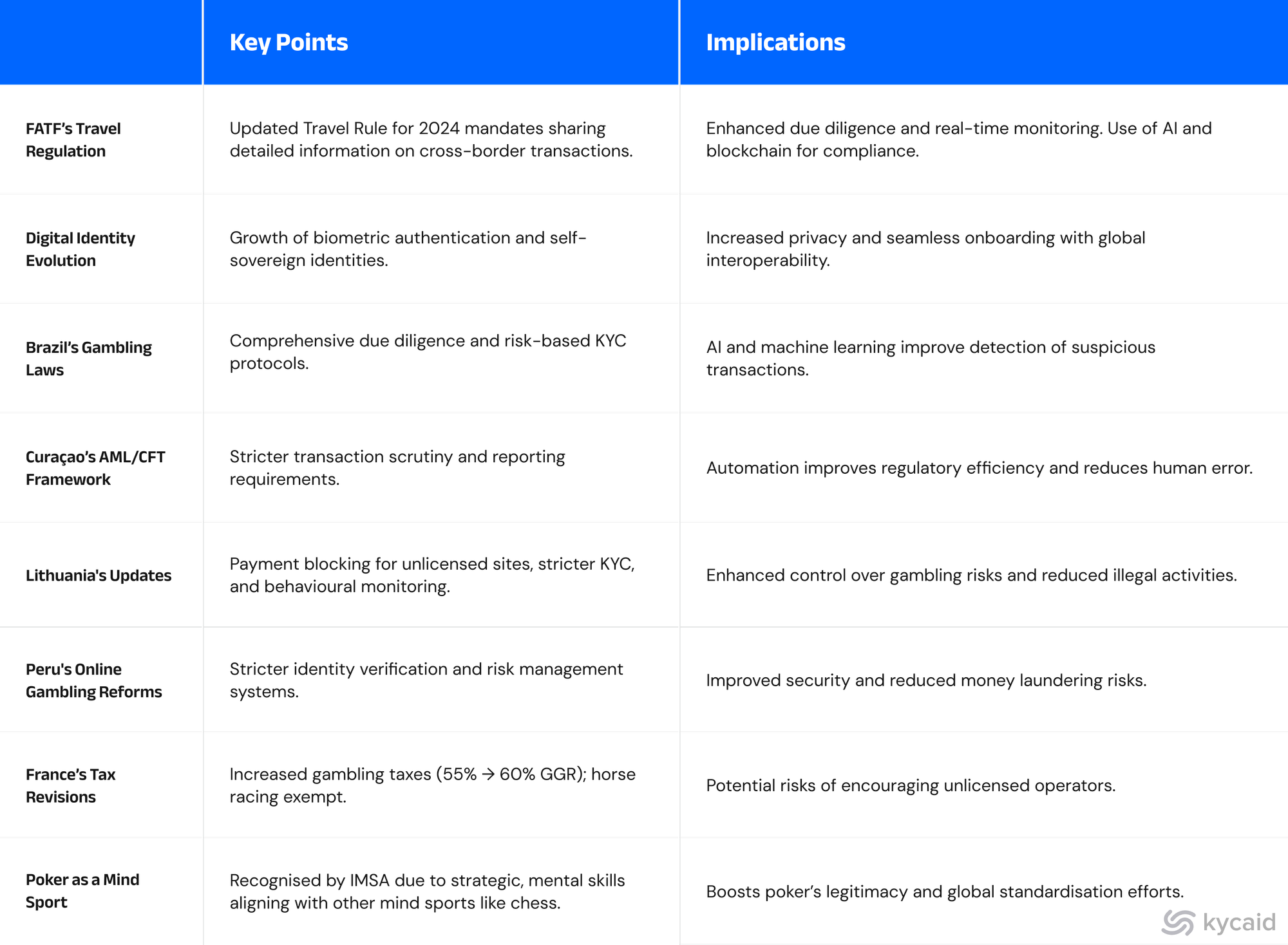

The Financial Action Task Force (FATF) has introduced an updated Travel Rule for 2024, which aims to strengthen cross-border transaction monitoring. This regulation mandates that financial institutions and businesses share detailed information on transactions exceeding specified thresholds. Entities are required to provide extensive details on both the originator and recipient of the transactions. Automated data-sharing technologies are increasingly being utilised, enabling real-time tracking and compliance across borders.

Under FATF’s oversight, institutions are mandated to enhance their due diligence practices, ensuring a higher level of scrutiny for high-risk customers and jurisdictions. The integration of advanced technologies, such as machine learning and blockchain, supports more efficient and accurate compliance processes. Non-compliance with these stringent requirements carries severe penalties, underlining the importance of adhering to FATF’s international standards.

The Evolution of Digital Identity and KYC Processes

The rise of digital identities has become a critical component of KYC and AML compliance in 2024. Across various industries, the adoption of advanced digital verification methods has become central to ensuring secure and seamless interactions between businesses and their clients.

Digital identity systems are increasingly incorporating biometric authentication, such as facial recognition and fingerprint scans, to verify users' identities. These measures enhance security while reducing friction during customer onboarding processes, all while maintaining high compliance standards. Furthermore, self-sovereign digital identities, supported by blockchain technology, are gaining traction. These decentralised solutions empower individuals to retain control over their personal data, reducing reliance on centralised databases and ensuring greater privacy. As governments and industries move towards standardising digital identity protocols, interoperability and global acceptance are becoming key priorities.

Brazil’s New Gambling Laws: Enhancing Fair Play and Compliance

Brazil has introduced substantial changes to its gambling regulations, focusing on more stringent KYC and AML measures. These updates are designed to create a more controlled and responsible gaming environment. One of the key aspects of Brazil’s revised framework is the emphasis on thorough due diligence. Gambling operators are now required to conduct comprehensive background checks on individuals and corporate entities involved in gambling activities. This aims to prevent financial misconduct and reduce the risk of involvement in illicit activities.

Additionally, Brazil has adopted a risk-based approach, tailoring KYC and AML protocols to the specific risks associated with different types of gambling. This flexible yet robust system allows operators to adapt compliance efforts according to the unique needs of their activities while meeting national and international standards.

The integration of advanced technology is central to these changes. By leveraging artificial intelligence (AI) and machine learning, operators can automate and enhance the detection of suspicious transactions, thereby improving security and compliance within the gambling sector.

Curaçao’s AML/CFT Framework: Strengthening Casino Compliance

Curaçao, a prominent hub for online gambling, has made significant advancements in tightening its AML and Counter-Terrorism Financing (CFT) regulations in 2024. These changes are aimed at aligning with global standards and enhancing transparency in the digital gambling industry. The revised regulations include more rigorous scrutiny of transactions and customer activities. Casinos operating under Curaçao’s jurisdiction are now required to submit detailed reports of any suspicious activities to the Curaçao Financial Intelligence Unit (FIU). This is crucial for identifying potential risks and ensuring timely regulatory intervention.

Additionally, Curaçao is embracing the use of technology in compliance processes. Automation tools, such as AI and blockchain, are being employed to streamline KYC verification and AML compliance. These innovations not only reduce human error but also improve the efficiency and accuracy of regulatory monitoring. The ultimate goal of these new regulations is to foster a safer gambling environment that meets both local and international standards.

Lithuania Reinforces Gambling Regulation

In 2024, Lithuania implemented several critical updates to its gambling regulations as part of a broader effort to enhance oversight and ensure a safer gaming environment. Key among these changes was the introduction of stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. Gambling operators—both land-based and online—were required to strengthen their due diligence processes, including thorough verification of players and continuous monitoring of transactions. This aimed to mitigate risks associated with financial crimes and to align with international regulatory standards.

Another major change introduced in 2024 was the requirement for financial institutions to block payments to unlicensed gambling sites. This measure was designed to curb illegal gambling activities and redirect users toward regulated operators. Additionally, gambling establishments were mandated to appoint specially designated employees responsible for monitoring player behaviour. These professionals were given the authority to temporarily suspend irresponsible players for up to forty-eight hours, ensuring better control over problematic gambling patterns.

Looking forward to 2025, Lithuania will further tighten its regulations. From July 1, 2025, the minimum age for participation in any form of gambling, excluding the national lottery, will increase to twenty-one, extending a restriction previously limited to land-based casinos. Gambling operators will also face a complete ban on advertising, with exceptions made for sports sponsorships until 2028. Online advertising for bookmakers will be permitted under strict limitations, including caps on the percentage of ad space used and time-specific restrictions. In addition, taxation on gambling operators' income will rise from twenty percent to twenty-two percent. The increased revenue is earmarked for public awareness campaigns about the risks of gambling and support for the media sector, which is expected to face financial challenges due to the advertising ban.

New AML and KYC Measures in Peru’s Online Gambling Sector

Peru has introduced stricter AML and KYC measures to enhance the integrity of its online gambling sector. These changes are designed to mitigate financial risks while promoting responsible gaming. Operators are now required to conduct thorough identity verification processes for all participants. This ensures that all users are legitimate and reduces the risk of money laundering. Additionally, advanced risk management systems are being integrated to monitor higher-risk customers more effectively, safeguarding against fraudulent activities.

France Raises Taxes on Gambling

France has announced a significant increase in taxes on its gambling industry, with the tax rate for operators rising from 55% to 60% of gross gaming revenue. However, horse racing has been exempted from this increase, following discussions with industry stakeholders.The new tax measures are part of a broader strategy to address the state deficit. However, experts caution that the increased taxation could inadvertently benefit unlicensed operators, while also potentially impacting the sports sector, which relies on sports betting revenues.

Poker Recognised as a Mind Sport

The International Mind Sports Association (IMSA) has officially recognised poker as a mind sport, categorising it alongside disciplines such as chess and cybersports. This decision follows years of advocacy by the World Poker Federation (WPF), which represents over 45 national federations.

The WPF has emphasised poker’s reliance on mental skill, strategic thinking, and concentration — qualities that align with IMSA’s criteria for mind sports. The recognition was announced at the BSOP Millions in São Paulo, Latin America’s largest poker event. The next step will involve standardising rules to protect players in competitive settings.

The Future of iGaming Compliance: AML and KYC Policies in 2025

As the iGaming industry steps into 2025, compliance with evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations remains a priority globally. Key regions like Latin America, Lithuania, the United States, and the United Kingdom are advancing measures to enhance financial security and consumer protection. Brazil leads Latin America with real-time CPF database integration, setting a robust example for regional compliance. Lithuania strengthens its oversight with advanced fraud detection tools, while the United States continues to navigate its state-specific regulatory landscape with growing federal interest. In the UK, stricter affordability checks and AI-driven compliance solutions highlight the Gambling Commission’s proactive approach. Across all regions, the integration of blockchain, machine learning, and real-time monitoring is driving innovation in compliance. These advancements underline the industry's commitment to transparency, security, and responsible gaming as it adapts to global standards.