Digital Fraud Trends: An Overview

Discover the evolving landscape of digital fraud in today’s interconnected world. Our blog offers comprehensive insights into the latest trends, preventive strategies, and advanced solutions to fortify your business against cyber threats. Stay informed, stay secure.

Navigating the Future of KYC: What to Expect in 2023

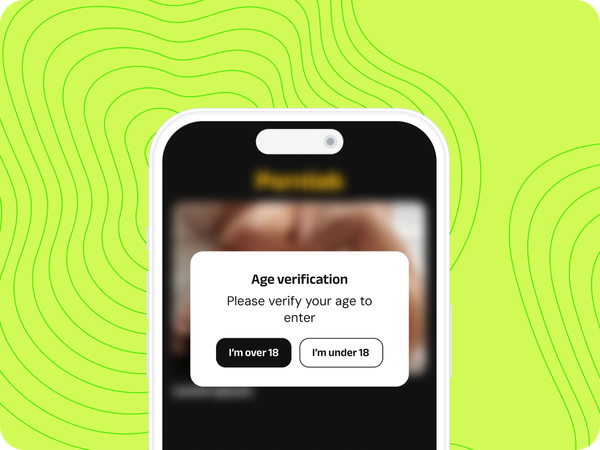

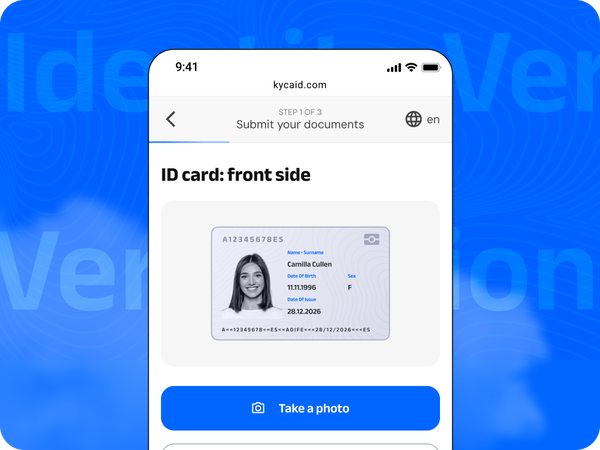

As the world moves further into the digital age, the need to protect customer identity online is becoming increasingly important. Financial organizations, in particular, must be able to identify and verify customers for compliance with anti-money laundering and know-your-customer (KYC) regulations. With developments in digital identity, blockchain technology, and artificial

KYC & AML Compliance in the USA

Today it's already a common practice for financial systems to use tools for clients' verification to prevent fraud and fight money laundering. The conditions of the current state of the banking system involve the absence of operations anonymity, financial organizations fighting for transaction transparency, moreover, it'

KYCAID Earns Compliance Management Software Recognition From a One of the Leading B2B Review Platform

KYCAID has earned a top rating from a leading software review platform—a distinction that provides further evidence of its position as a leading software to businesses worldwide. FinancesOnline has recognized our product with the Top 50 Compliance Management Software and Rising Star Award. This award celebrates our rapid growth

5 Tips on Picking the Best KYC Compliance Management Software to Fit Your Business Needs

Money laundering is a serious global issue, and KYC compliance management is critical to the fight against it. The right software can make all the difference in your business' compliance management program. A growing number of businesses worldwide are implementing Know-Your-Customer (KYC) compliance management software in their business models—

GUIDE: AML compliance for Marijuana-related businesses

When getting into business relations with the Cannabis business industry one must correctly identify whether the business or the beneficial owner is considered to be a high-risk one. Depending on whether the business is producing cannabis products or touches upon the support of producers - the risk level varies. Marijuana-related

Arbitrage Betting: Does It Harm Betting Businesses and What Is the Role of KYC in Detecting Arbers?

Arbitrage betting is an undesired occurrence for many bookmakers. Discover how KYC can help identify arbers while keeping your business secure and your customers – satisfied.

Kycaid Obtains Compliance Management Software Accolade From A-list B2B Platform

Recently, Kycaid’s compliance management software gained due industry recognition with an award from an A-list B2B directory. CompareCamp, one of the current A-listers in the software marketplace category, bestowed Kycaid with a Rising Star Award, recognizing our product’s widening user base and increasing fame. This award is the

5 Reasons Why Identity Verification Solutions Should Be a New Standard for Every Serious Business Venture

Digitalization brings new challenges and risks to businesses and consumers. By making data more accessible than ever, cybercrimes such as data breaches, identity theft, and fraud are more rampant than ever. You need to invest in the right tools to protect your company and customers from potential threats and attacks

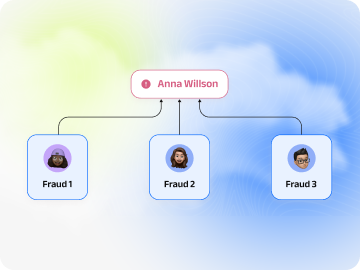

Multi-Accounting: is your business at risk?

Multi-accounting is a number of accounts on one site (a social network, a special online service, and so on) that are managed by one person. It is used in completely different areas — for working with social networks, online shops, bets, and token sales. Users create dozens of accounts and, accordingly,

How NFC Technology Might Be Applied for Verifying Customers

The technology of NFC is becoming more common today and this is just a matter of time before everyone starts applying it for the identity verification procedures. Will it be efficiently applied, and what benefits such NFC-based technologies might potentially bring to your enterprise? Keep reading to figure this out.

Combating Fraud in The Field Of Finance

The problems of ensuring the economic security of any state are increasingly attracting the attention of the authorities, the public, and the scientific community. Economic security is a complex category reflecting all levels of public life. A high level of financial safety can be achieved only if effective methods of