Leading KYC & AML compliance solution

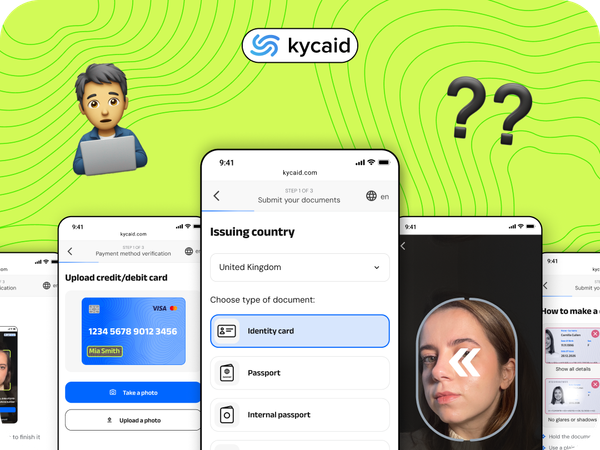

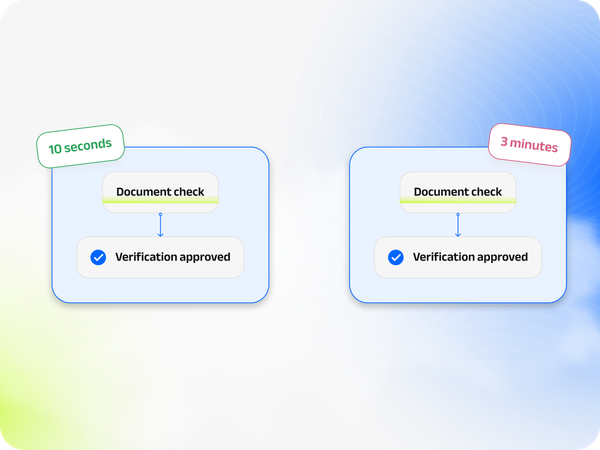

A Step-by-Step Guide to Remote Customer Verification

Remote customer verification ensures security, compliance, and fraud prevention using biometrics, AI, and official records. KYCAID provides seamless, AI-driven verification with global coverage and real-time fraud detection.

A Guide to Global KYC Regulations: Key Differences by Region

Discover how KYC regulations differ across regions, including the US, EU, UK, and Asia-Pacific. Learn how KYCAID can help simplify global compliance with advanced identity verification and risk management solutions.

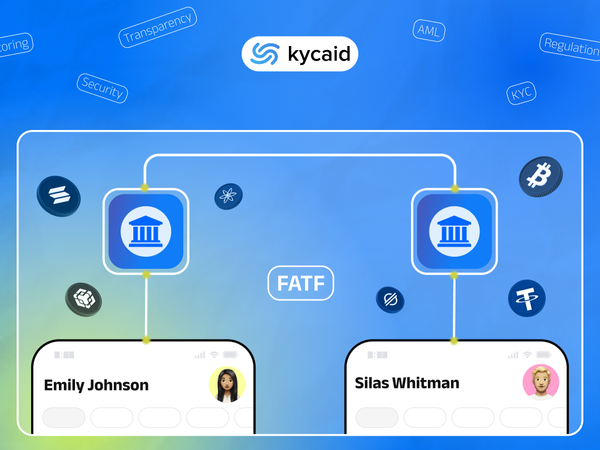

Understanding the EU Crypto Travel Rule: Key Compliance Insights for CASPs

EU TFR & Travel Rule: CASP Compliance From 30 Dec 2024, CASPs must ensure full transparency in crypto transactions by collecting originator & beneficiary data, enforcing the zero-threshold Travel Rule, and verifying self-hosted wallets.

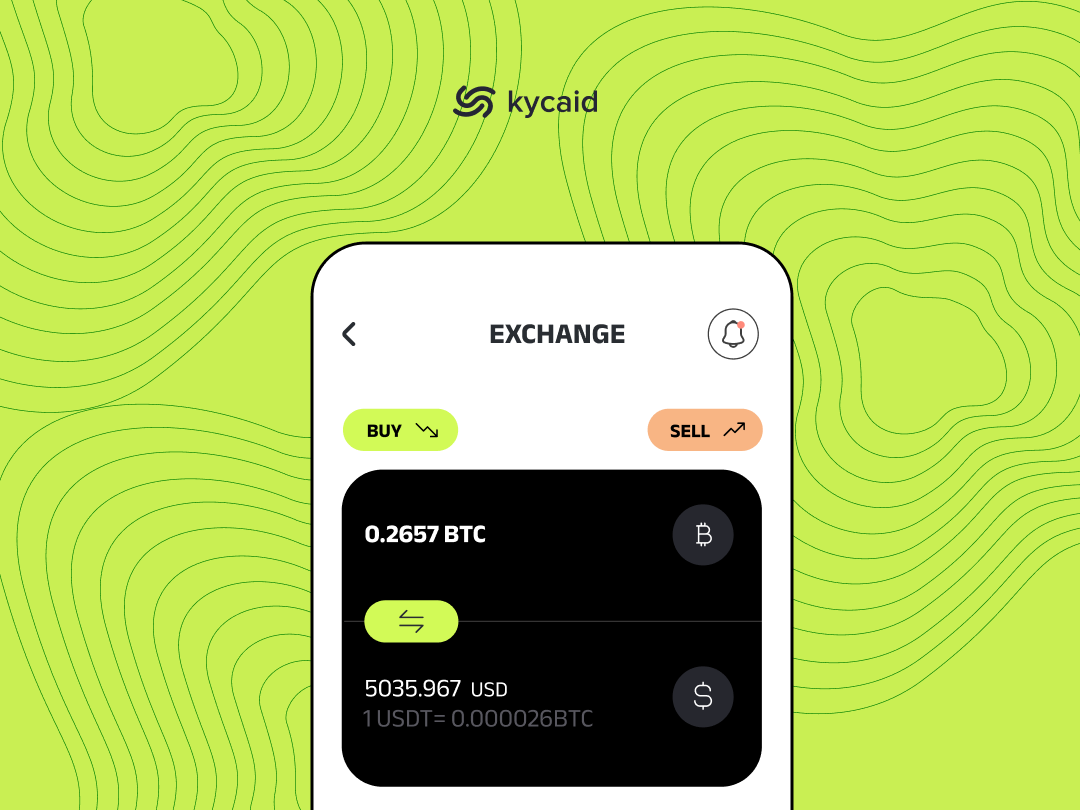

The Importance of KYC for Crypto Exchanges

KYC for crypto exchanges is vital for security and compliance. Crypto compliance solutions ensure AML and KYC in cryptocurrency, reducing fraud. Digital identity verification for crypto enhances trust, while blockchain KYC solutions streamline regulatory adherence for safer transactions.

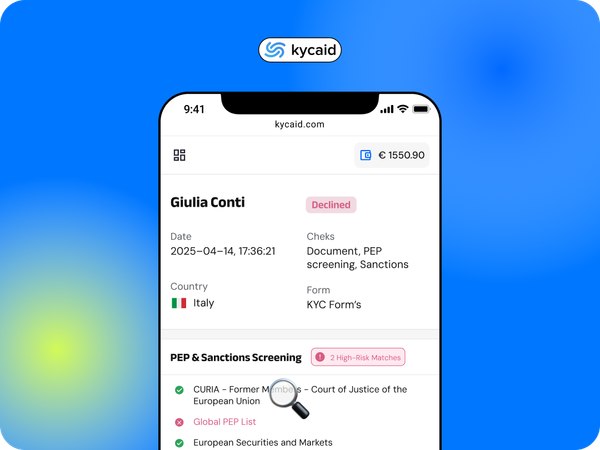

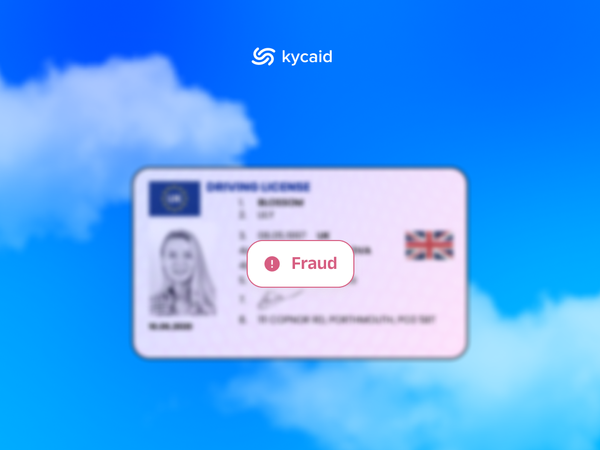

How KYC Prevents Fraud: Advanced Strategies for Financial Security

Discover how KYC (Know Your Customer) solutions prevent fraud by verifying identities, analyzing behavior, and ensuring compliance with global regulations. Learn about AI-driven tools, real-time monitoring, and multi-industry benefits. Safeguard your business today!

Sweepstakes Casinos in 2024: Trends and the Role of Verification for Growth and Compliance

Explore the rapid growth of sweepstakes casinos in 2024, driven by gamification, mobile-first gaming, and robust verification processes ensuring compliance, trust, and innovation. Discover trends like AR/VR, cryptocurrency, and eco-conscious campaigns shaping this risk-free entertainment space.

Digital Fraud Trends: An Overview

Discover the evolving landscape of digital fraud in today’s interconnected world. Our blog offers comprehensive insights into the latest trends, preventive strategies, and advanced solutions to fortify your business against cyber threats. Stay informed, stay secure.

5 Tips on Picking the Best KYC Compliance Management Software to Fit Your Business Needs

Money laundering is a serious global issue, and KYC compliance management is critical to the fight against it. The right software can make all the difference in your business' compliance management program. A growing number of businesses worldwide are implementing Know-Your-Customer (KYC) compliance management software in their business models—

Arbitrage Betting: Does It Harm Betting Businesses and What Is the Role of KYC in Detecting Arbers?

Arbitrage betting is an undesired occurrence for many bookmakers. Discover how KYC can help identify arbers while keeping your business secure and your customers – satisfied.

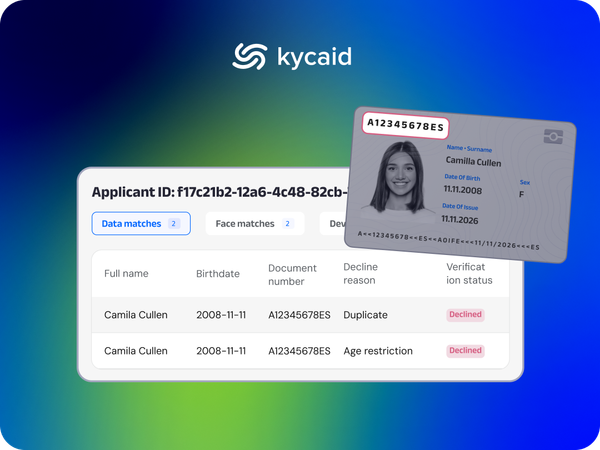

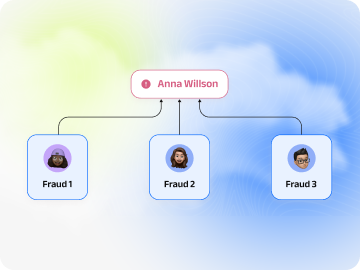

Multi-Accounting: is your business at risk?

Multi-accounting is a number of accounts on one site (a social network, a special online service, and so on) that are managed by one person. It is used in completely different areas — for working with social networks, online shops, bets, and token sales. Users create dozens of accounts and, accordingly,

Combating Fraud in The Field Of Finance

The problems of ensuring the economic security of any state are increasingly attracting the attention of the authorities, the public, and the scientific community. Economic security is a complex category reflecting all levels of public life. A high level of financial safety can be achieved only if effective methods of

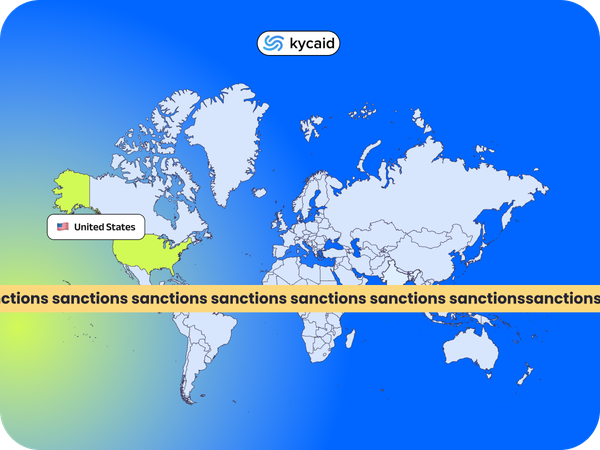

What do you need to know about sanctions and how to avoid risks

The tense international situation provoked the introduction of new sanctions restrictions. A natural question that arises for every entrepreneur is how to find alternative solutions. How can they continue working given the current situation? To answer these questions, it will be necessary to consider several important innovations that will help

What is money laundering and how do you protect your assets?

Money laundering is a problem that will not lose its relevance in 2022. Financial transactions involve "money mules". These are people who receive money from a third party into their own account and transfer it to another person or company. Transactions are usually done online. However, it is