Leading KYC & AML compliance solution

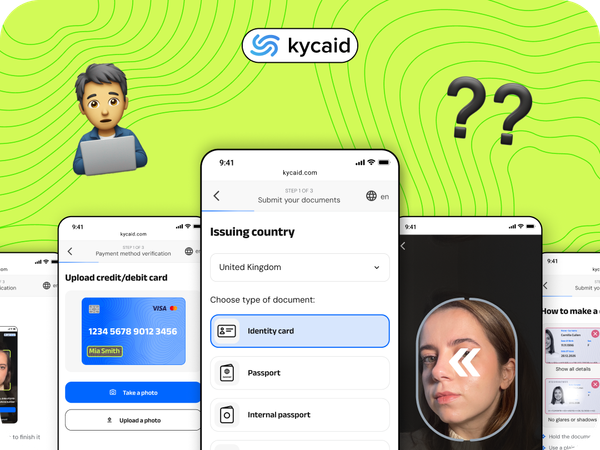

A Step-by-Step Guide to Remote Customer Verification

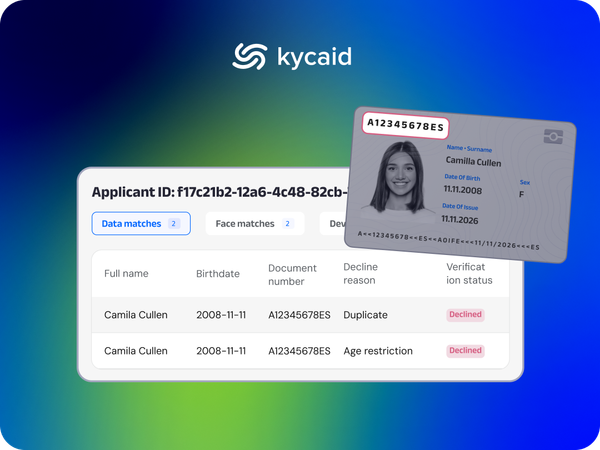

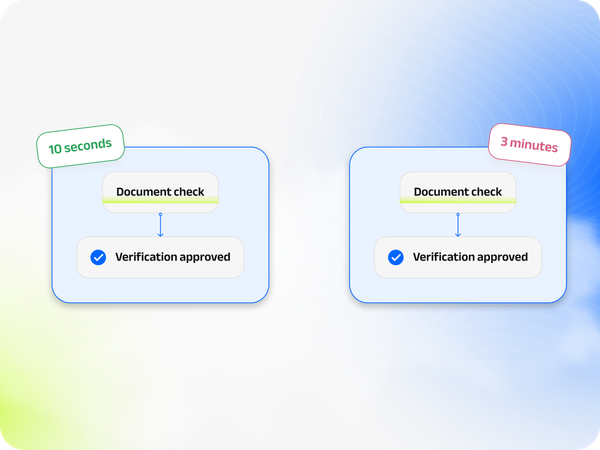

Remote customer verification ensures security, compliance, and fraud prevention using biometrics, AI, and official records. KYCAID provides seamless, AI-driven verification with global coverage and real-time fraud detection.

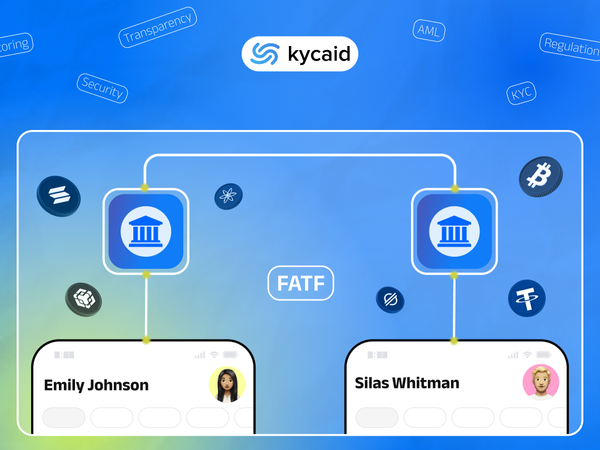

A Guide to Global KYC Regulations: Key Differences by Region

Discover how KYC regulations differ across regions, including the US, EU, UK, and Asia-Pacific. Learn how KYCAID can help simplify global compliance with advanced identity verification and risk management solutions.

Understanding the EU Crypto Travel Rule: Key Compliance Insights for CASPs

EU TFR & Travel Rule: CASP Compliance From 30 Dec 2024, CASPs must ensure full transparency in crypto transactions by collecting originator & beneficiary data, enforcing the zero-threshold Travel Rule, and verifying self-hosted wallets.

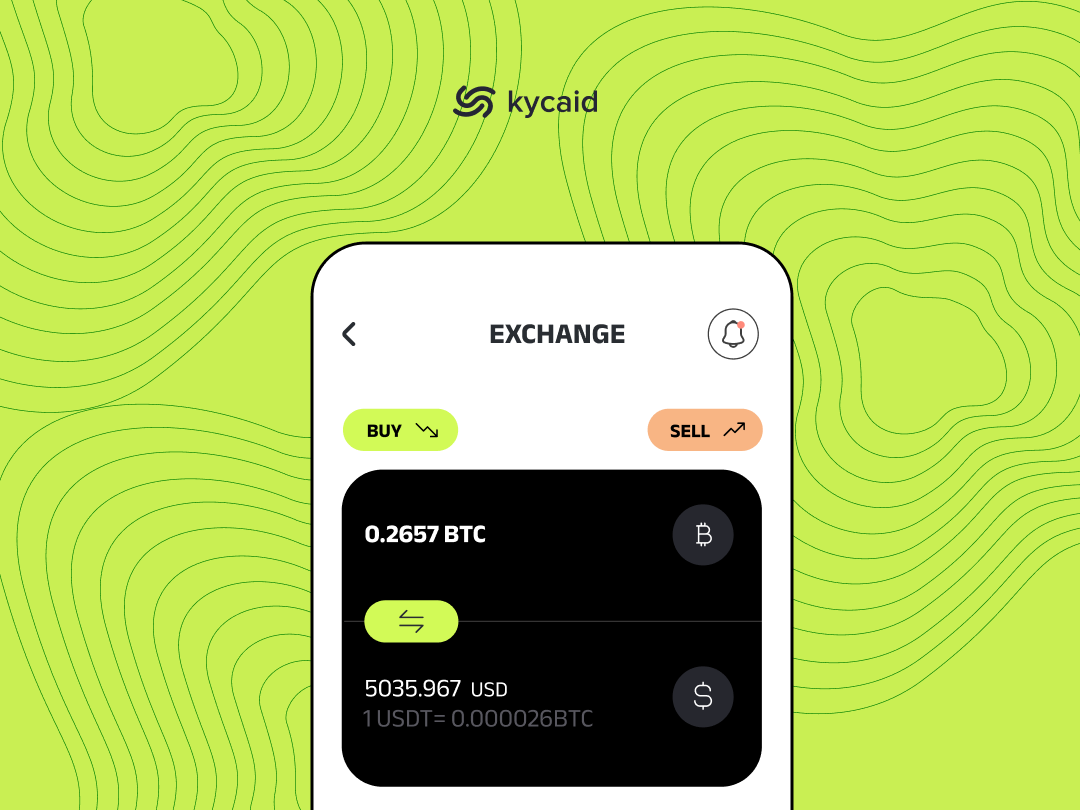

The Importance of KYC for Crypto Exchanges

KYC for crypto exchanges is vital for security and compliance. Crypto compliance solutions ensure AML and KYC in cryptocurrency, reducing fraud. Digital identity verification for crypto enhances trust, while blockchain KYC solutions streamline regulatory adherence for safer transactions.

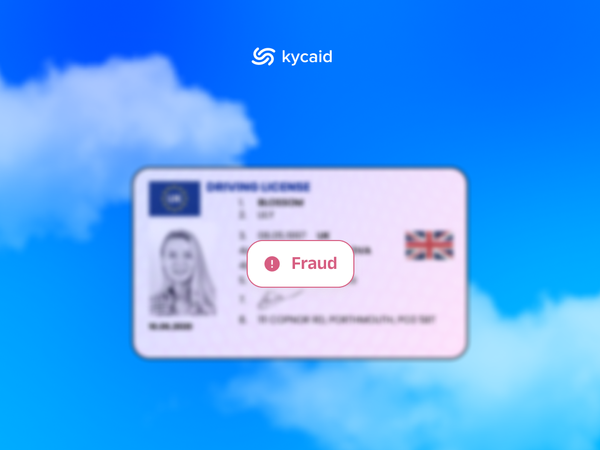

How KYC Prevents Fraud: Advanced Strategies for Financial Security

Discover how KYC (Know Your Customer) solutions prevent fraud by verifying identities, analyzing behavior, and ensuring compliance with global regulations. Learn about AI-driven tools, real-time monitoring, and multi-industry benefits. Safeguard your business today!

Sweepstakes Casinos in 2024: Trends and the Role of Verification for Growth and Compliance

Explore the rapid growth of sweepstakes casinos in 2024, driven by gamification, mobile-first gaming, and robust verification processes ensuring compliance, trust, and innovation. Discover trends like AR/VR, cryptocurrency, and eco-conscious campaigns shaping this risk-free entertainment space.

Digital Fraud Trends: An Overview

Discover the evolving landscape of digital fraud in today’s interconnected world. Our blog offers comprehensive insights into the latest trends, preventive strategies, and advanced solutions to fortify your business against cyber threats. Stay informed, stay secure.

Navigating the Future of KYC: What to Expect in 2023

As the world moves further into the digital age, the need to protect customer identity online is becoming increasingly important. Financial organizations, in particular, must be able to identify and verify customers for compliance with anti-money laundering and know-your-customer (KYC) regulations. With developments in digital identity, blockchain technology, and artificial

KYC & AML Compliance in the USA

Today it's already a common practice for financial systems to use tools for clients' verification to prevent fraud and fight money laundering. The conditions of the current state of the banking system involve the absence of operations anonymity, financial organizations fighting for transaction transparency, moreover, it'