Leading KYC & AML compliance solution

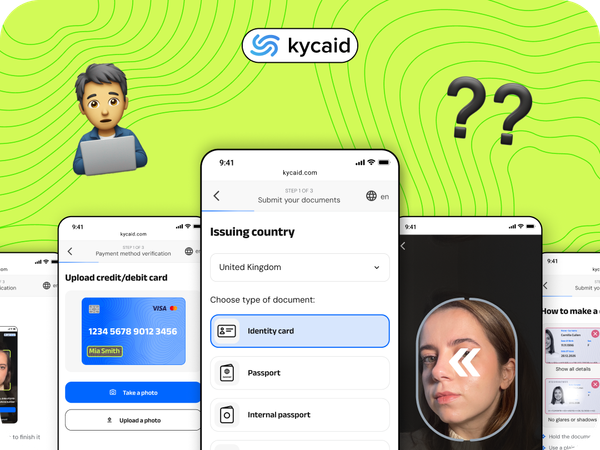

A Step-by-Step Guide to Remote Customer Verification

Remote customer verification ensures security, compliance, and fraud prevention using biometrics, AI, and official records. KYCAID provides seamless, AI-driven verification with global coverage and real-time fraud detection.

A Guide to Global KYC Regulations: Key Differences by Region

Discover how KYC regulations differ across regions, including the US, EU, UK, and Asia-Pacific. Learn how KYCAID can help simplify global compliance with advanced identity verification and risk management solutions.

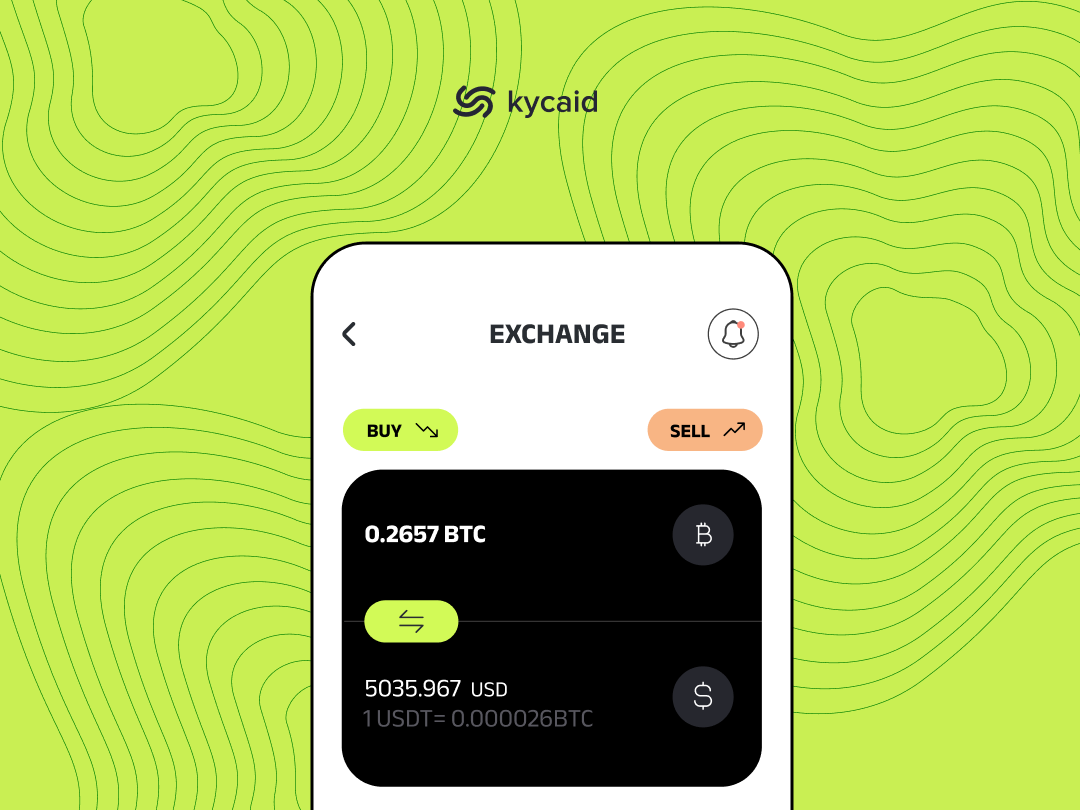

The Importance of KYC for Crypto Exchanges

KYC for crypto exchanges is vital for security and compliance. Crypto compliance solutions ensure AML and KYC in cryptocurrency, reducing fraud. Digital identity verification for crypto enhances trust, while blockchain KYC solutions streamline regulatory adherence for safer transactions.

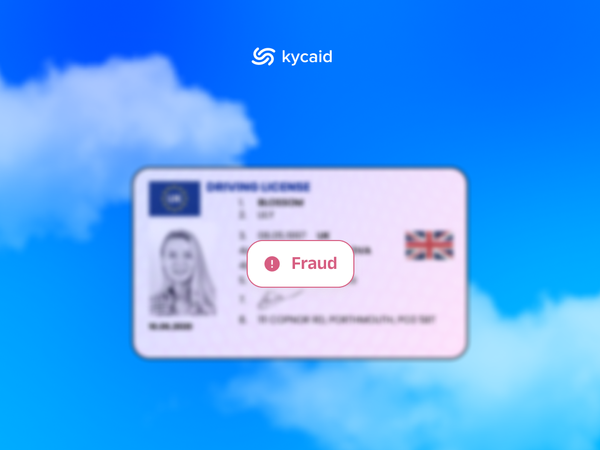

How KYC Prevents Fraud: Advanced Strategies for Financial Security

Discover how KYC (Know Your Customer) solutions prevent fraud by verifying identities, analyzing behavior, and ensuring compliance with global regulations. Learn about AI-driven tools, real-time monitoring, and multi-industry benefits. Safeguard your business today!

Sweepstakes Casinos in 2024: Trends and the Role of Verification for Growth and Compliance

Explore the rapid growth of sweepstakes casinos in 2024, driven by gamification, mobile-first gaming, and robust verification processes ensuring compliance, trust, and innovation. Discover trends like AR/VR, cryptocurrency, and eco-conscious campaigns shaping this risk-free entertainment space.

Navigating the Future of KYC: What to Expect in 2023

As the world moves further into the digital age, the need to protect customer identity online is becoming increasingly important. Financial organizations, in particular, must be able to identify and verify customers for compliance with anti-money laundering and know-your-customer (KYC) regulations. With developments in digital identity, blockchain technology, and artificial

How NFC Technology Might Be Applied for Verifying Customers

The technology of NFC is becoming more common today and this is just a matter of time before everyone starts applying it for the identity verification procedures. Will it be efficiently applied, and what benefits such NFC-based technologies might potentially bring to your enterprise? Keep reading to figure this out.

An Insider’s Look at RegTech

Many who are knowledgeable about Know-Your-Customer (KYC) and Anti-Money Laundering (AML) come from a financial institution background. They have a keen awareness of the challenges in maintaining high standards of compliance. These requirements apply not only to banks but also to companies and platforms that partner with credit unions and

What is Identity Verification? Understanding Its Importance and Benefits

Introduction for the newbies What is identity verification? Identity verification is used in various fields, from banking institutions to hospitals. After passing the check, the person confirms that it is he who performs specific actions and this is not an attempt to cheat. This system is used by financial companies.

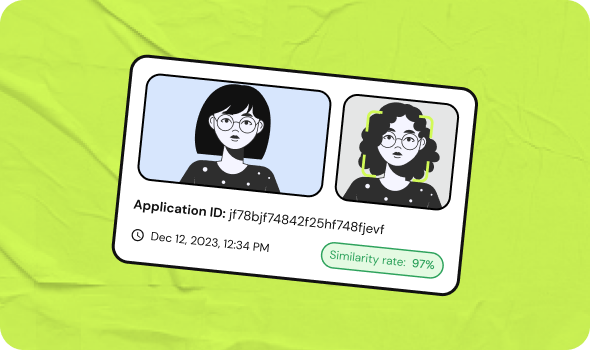

Face Recognition Technologies

What do we actually know about Face Recognition Technologies? You deal with face recognition technology almost every day, but you hardly ever really thought about it, do you? The first thing that comes to mind is a face ID to unlock your mobile phone, which obviously from the title uses

Deepfakes and online identity verification

Identity falsification occurs in all areas. You might have seen face replacement technology on the Internet when someone used the faces of famous people to create videos. The usage of artificial intelligence has made this method dangerous in many areas. That is the reason for the dissemination of false information,