⌚6 min to read

Know Your Customer services have come a long way from the days of endless paperwork and manual verification processes. In recent years, the evolution of KYC services has taken a great leap forward, moving towards non-document verification methods. This shift has not only streamlined the customer onboarding process but has also enhanced security and efficiency for businesses. With the advent of advanced technologies and innovative solutions, KYC services have transformed into a seamless and user-friendly experience.

A little bit of the History: How KYC Started

Understanding customers has always played a fundamental role in business dealings. Trust and mutual comprehension between parties have been crucial for sustainable and successful business relationships. The structured practice of KYC, as we know it today, developed in response to the growing challenges posed by financial crimes such as fraud and money laundering.

The roots of KYC are linked to the U.S. Bank Secrecy Act (BSA) of 1970, which obligated financial institutions to establish systems for detecting and reporting suspicious transactions. This paved the way for Anti-Money Laundering (AML) laws that required financial institutions to verify their customers' identities.

In the 1970s and 1980s, a rise in prominent cases of organized crime, narcotics trafficking, and money laundering prompted governments to recognize the need for stronger oversight. Consequently, the Bank of England introduced the first formal KYC guidelines in the early 1990s. This development coincided with the establishment of the Financial Action Task Force (FATF) during the 1989 G7 Summit in Paris.

Traditional KYC: Paper-Based Documentation

Historically, KYC relied heavily on manual processes and paperwork checks. Customers were required to submit physical copies of identification such as passports, driver's licenses, utility bills, and other documents. Banks and financial entities would then manually review these documents for authenticity. These processes demand substantial investments in staff training and infrastructure to comply with all regulatory requirements. A time-consuming and error-prone process that could result in significant delays in onboarding new customers.

Moreover, the manual nature of paperwork-based KYC presented increased risks of fraud and identity theft. Verifiers could make mistakes or be deceived by counterfeit documents, leading to potential security breaches. These challenges highlighted the need for a more efficient, secure, and reliable approach to customer verification.

The Emergence of Digital KYC

With advances in technology, Know Your Customer processes began to evolve, embracing digital solutions that offered more efficient and streamlined identity verification. The shift from paper-based to digital verification enabled businesses to confirm customers' identities more quickly and securely.

Gone are the days when customers had to fill out lengthy forms, submit multiple documents, and wait for days or weeks for their verification to be completed. The introduction of digital verification methods has revolutionized the way businesses verify their customers' identities. Now, customers can simply provide their personal information online, and through various authentication techniques like biometrics, artificial intelligence, and machine learning algorithms, their identities can be verified in a matter of seconds.

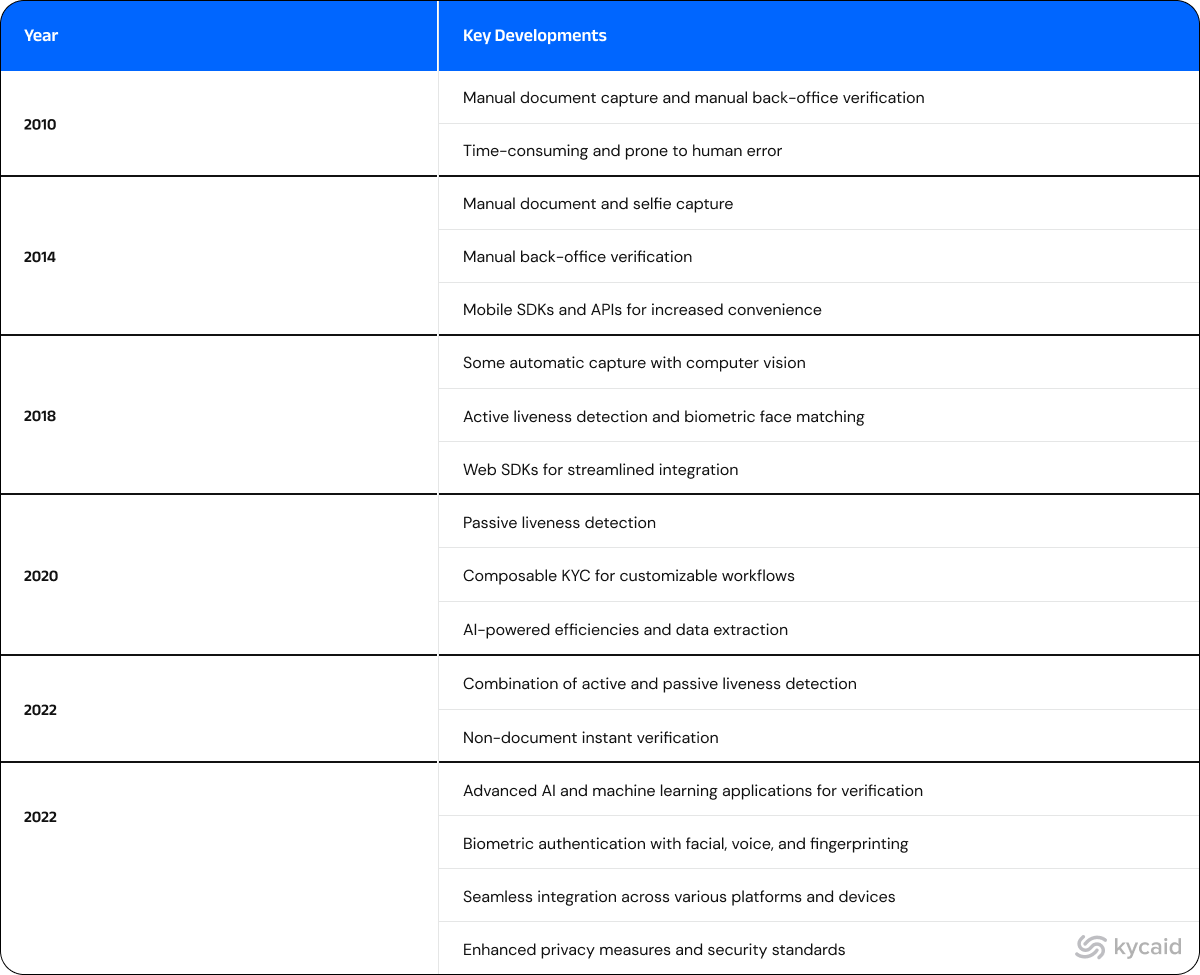

Key developments in digital Know Your Customer include:

- Electronic Document Verification: Customers could submit digital copies of their identification documents, which were verified electronically, reducing the need for manual checks and accelerating the verification process.

- Biometric Identification: The introduction of biometric identification, such as facial recognition, has added an extra layer of security to the verification process, making it more challenging for fraudsters to impersonate customers.

- Active Liveness Checks: Active liveness checks require the user to perform specific actions during the verification process. This may include turning their head, blinking on command, or following other prompts. These checks ensure that the user is present and responsive, reducing the risk of impersonation using static images or videos.

- Passive Liveness Checks: Passive liveness checks utilize advanced algorithms to analyze a live video stream of the user's face. These checks can detect natural movements and facial expressions without requiring specific user input. Passive liveness checks are effective in preventing spoofing attempts using images or pre-recorded videos.

- Non-document Verification: Speed and simplicity are revolutionizing identity verification processes by offering a user-friendly approach that eliminates the need for physical documents.

The Evolution of KYC Services Table

Non-document Verification

The shift towards non-document verification methods has not only made the KYC process faster but has also significantly reduced the risk of human error. With manual verification processes, there was always a chance of errors creeping in, leading to delays and inefficiencies. However, with non-document verification methods, the reliance on human intervention is minimized, ensuring accurate and reliable results.

While non-document verification is not available globally, it is accessible in some countries with digital citizen databases that grant access to identity verification service providers. This method offers quick, convenient services that enhance the customer experience while boosting operational efficiency and trust.

- Onboarding Experience: Non-document verification offers a seamless experience with simple steps. The process begins with entering the document number and undergoing a face detection and liveness test. The system then cross-checks records against the government database to complete user verification, providing an instant and accurate outcome.

- Instantaneous Verification Results: Advanced technology ensures instantaneous verification results, saving customers valuable time and reducing friction.

- Government-Sourced Personal Details: Leveraging government-sourced personal details for various identification numbers ensures the authenticity and reliability of the information provided.

- Compliance Assurance: Secure government database checks help maintain compliance with regulatory standards worldwide.

- Fraud Prevention: Thorough verification processes, including optional liveness checks, help establish a secure environment and prevent advanced fraud attacks.

KYCAID offers non-document verification services across multiple countries, including Brazil, Mexico, India, Ukraine, Kazakhstan, Turkey, Peru, and South Africa.

The Future of Know Your Customer Processes

The evolution from paper-based documentation to non-document verification represents a significant leap in identity verification processes. As technology continues to advance, customer verification is likely to become even more efficient, secure, and user-friendly.

Future Trends:

- The Role of AI and Machine Learning: AI and machine learning can analyze vast amounts of data to identify patterns and potential risks, helping to improve fraud detection and streamline the verification process.

- Enhanced Biometric Solutions: Sophisticated facial recognition and voice authentication technologies can further enhance the security and accuracy of identity verification.

- Cross-Border Verification: As global business and travel increase, cross-border verification will become more important, requiring verification processes to adapt to international standards and regulations.

- User-Centric Approaches: Future verification services will prioritize user-centric approaches, offering more seamless and personalized experiences for customers.

The evolution from paperwork checks to non-document verification methods has significantly improved efficiency, security, and user experience. Businesses can now onboard customers quickly while ensuring their identities are verified accurately and securely. As technology continues to advance, we can expect further innovations in the field of KYC services, making the process even more seamless and user-friendly.