In the realm of Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, screening for Politically Exposed Persons (PEPs) is not only a best practice—it's a regulatory need. Financial institutions and controlled companies have to be set up to identify and evaluate the risk involved in doing business with people in political power. Ignoring this responsibility may cause major legal and reputation harm to companies. The value of PEP screening, the hazards related to PEP exposure, and how these people are characterised and categorised are investigated in this paper.

Any strong AML/KYC system revolves mostly on PEP screening. These people are more likely to be involved in or vulnerable to financial crimes—especially corruption and money laundering—because of their influence and access to public money or decision-making authority. Globally, regulators demand financial institutions to find PEPs, evaluate the related risks, and, when needed, perform increased due diligence (EDD).

Screening benefits institutions by:

- Steer clear of unwittingly supporting criminal conduct.

- Under international rules (e.g., FATF guidelines), fulfil legal duties.

- Make wise risk-based judgements.

Organisations run the danger of losing compliance without appropriate PEP screening, which might result in fines, penalties, and public confidence eroding.

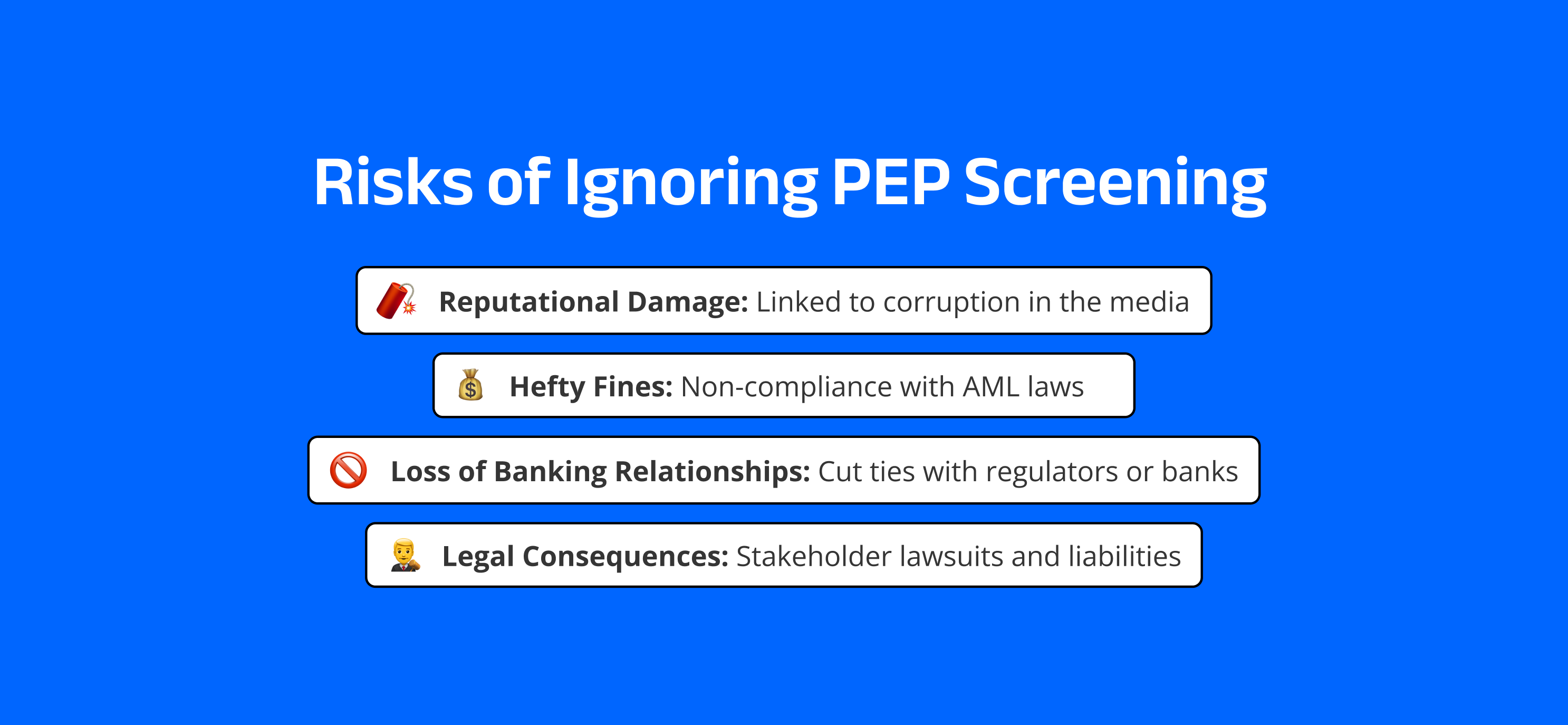

An Overview of the Legal and Reputation Risks Connected to PEP Exposure

Ignorance of appropriate screening and management of connections with PEPs can have grave results:

- Media investigation can damage the image of a brand, particularly if it is connected to well-known corruption scandals.

- Penalties and fines imposed by authorities for non-compliance with AML rules could be really large.

- Non-compliance can cause authorities or correspondent banks to cut ties, therefore affecting business operations by loss of business licenses or banking links.

- Legal action could be pursued by impacted parties or stakeholders, therefore stressing operations and finances.

Effective PEP risk management by institutions shows a proactive compliance culture and helps them to build market trust.

PEP, or Politically Exposed Persons, What Are They?

Typical PEPs are:

- Heads of state or government – e.g., presidents, prime ministers

- Senior politicians – e.g., cabinet members, parliamentarians

- High-ranking military officers

- Senior judicial officials – e.g., supreme court judges

- Executives of state-owned enterprises or international organisations – e.g., CEOs of national oil companies, directors at the UN

Relatives, and Close Associates (RCAs)

PEPs carry hazards not only for the person themselves. Regulatory agencies also devote great focus to:

- Relatives: Parents, children, spouses, and other family members maybe influenced by the PEP.

- Close associates: Business partners, consultants, or anyone intimately involved in the financial operations of a PEP.

Why Is PEP High Risk?

Corruption, Bribery, Money Laundering Risk

A PEP's position usually grants them access to public money, decision-making authority, or regulatory power. This renders them open to:

- Accepting or requesting bribes

- Misappropriating public money

- Using influence or insider knowledge, facilitating money laundering programs

More Scrutiny from Financial Institutions and Regulators

PEPs draw more government interest since of their higher risk profile. Institutions handling PEPs have to be able to show solid internal controls, EDD procedures, and continuous monitoring systems. Regulatory audits could concentrate especially on the way the institution handles PEP ties.

Principal Elements of PEP Screening

- Comprehensive and routinely updated databases list known PEPs and associated companies

- Watchlists include law enforcement databases, regulatory enforcement lists, and worldwide sanctions lists

- Media monitoring and news sources enable one to find reputational hazards connected to criminal accusations or corruption

PEP Screening Timings

Screening should be included into the client life at several stages:

- At onboarding, to find PEP status right away

- Constant observation helps one to identify changes in status, affiliations, or new risk variables across time

- Regular evaluations—particularly for high-risk consumers

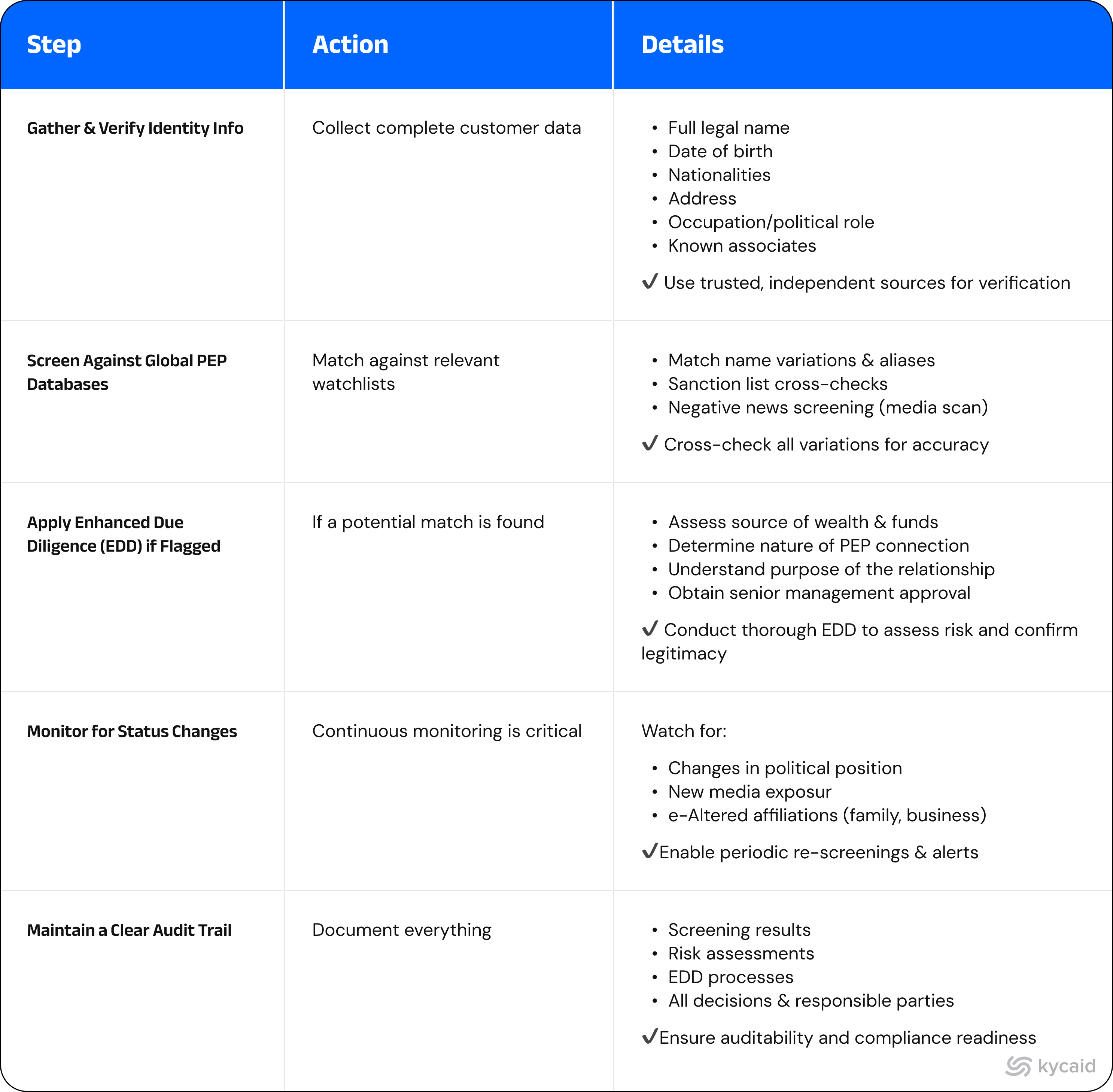

Methodical Guide to PEP Screening

Challenges in PEP Screening

Efforts at counter-terrorism financing (CTF) and anti-money laundering (AML) rely especially on politically exposed persons (PEPs). Clients of banks, financial institutions, and other regulated businesses must undergo PEP screening to identify any individuals who have either held or presently hold a prominent public function. Still, this method can be challenging. Together with remedies, these are some of the primary difficulties businesses face during PEP screening.

1. False Positives: Minish Them?

False positives present among the biggest challenges of PEP screening. These result from the system flagging someone as a PEP who isn't truly politically exposed, leading to fruitless searches and delays. Regarding time and money, this can be costly; also, it may affect the client experience.

Reducing False Positives:

- Regular PEP database updates and dependable data source utilisation will help to ensure that the used content is current and accurate.

- By themselves, advanced filtering and matching systems can help to reduce false positives. This can call for including contextual analysis, fuzzy matching, and machine learning techniques.

- By means of additional background checks, extra due diligence (EDD) and validation of the identity of identified individuals help to reduce false positives even more.

2. Control of Alias Names and Local Language Variations

Variations in local dialects, transliterations, and aliases add still another degree of difficulty to PEP screening. An individual may be known by aliases the screening system does not immediately identify or have many names in several languages.

Control Name Variations:

- By use of screening techniques spanning several languages and letter sets—e.g., Cyrillic, Arabic, Chinese—ensures that the system can detect possible matches across several geographical areas.

- By including more exact search filters and merging alias databases, one can manage individuals using aliases and hence improve the screening process.

- By means of local regulatory bodies and compliance experts, one can ensure that the system is aware of usual deviations and aliases in specific regions.

3. Ensuring Real-Time Updates with Worldwide Coverage

Main challenges in PEP screening include keeping real-time updates and guaranteeing global coverage. PEP lists are continuously changing and new people are added or removed quite regularly. Older data can raise non-compliance issues and cause missing prospective dangers.

Guaranteeing Worldwide Coverage:

- One can help lower the risk of obsolete information depending on trustworthy global PEP data sources who continuously update their records.

- Including subscription-based services and real-time data feeds guarantees that the screening process remains current, therefore allowing timely updates on changes in PEP status.

4. GDPR, CCPA: Compliance on Data Privacy

The California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) force organisations to navigate challenging requirements about handling sensitive data with rigorous data protection policies.

Following Data Privacy Laws:

- Minimising Data: Just compile the necessary data for PEP screening; ensure local compliantly maintained and handled personal data.

- Customers should be informed on how their data will be handled, stored, and used for compliance requirements, so guaranteeing the suitable acquisition of permission.

- Install robust security standards including encryption to protect confidential customer data from leakage.

5. PEP Screening: Regulatory Policies

Legal requirements for PEP screening vary among nations; so, businesses must ensure that their compliance strategies complement the specific laws and regulations in place.

Essential Regulatory Systems:

- Advice from FATF: Recommendations released by the Financial Action Task Force (FATF) direct countries towards building robust anti-money laundering systems. FATF's recommendations highlight the need of PEP screening as a component of a broader general customer due diligence process including ongoing monitoring.

- The European Union's Anti-Money Laundering Directives (5AMLD, 6AMLD): These necessitate regular PEP screening updates. These guidelines stress the need of verifying their identification and knowing the source of PEP money.

- FinCEN (US) Guidelines: Following the Bank Security Act (BSA) and other AML regulations, the Financial Crimes Enforcement Network (FinCEN) orders American banks to PEP screening using risk-based approaches. This covers search for PEPs both domestically and abroad.

Industry-Specific PEP Screening: Related regulatory responsibilities abound in many sectors, including insurance, bitcoin exchanges, and banking. For many nations, the crypto industry is subject to more rigorous KYC/AML regulations, for example, which requires further PEP screening for both individuals and businesses involved in bitcoin transactions.

KYCAID’s Approach to PEP Screening and Risk Scoring

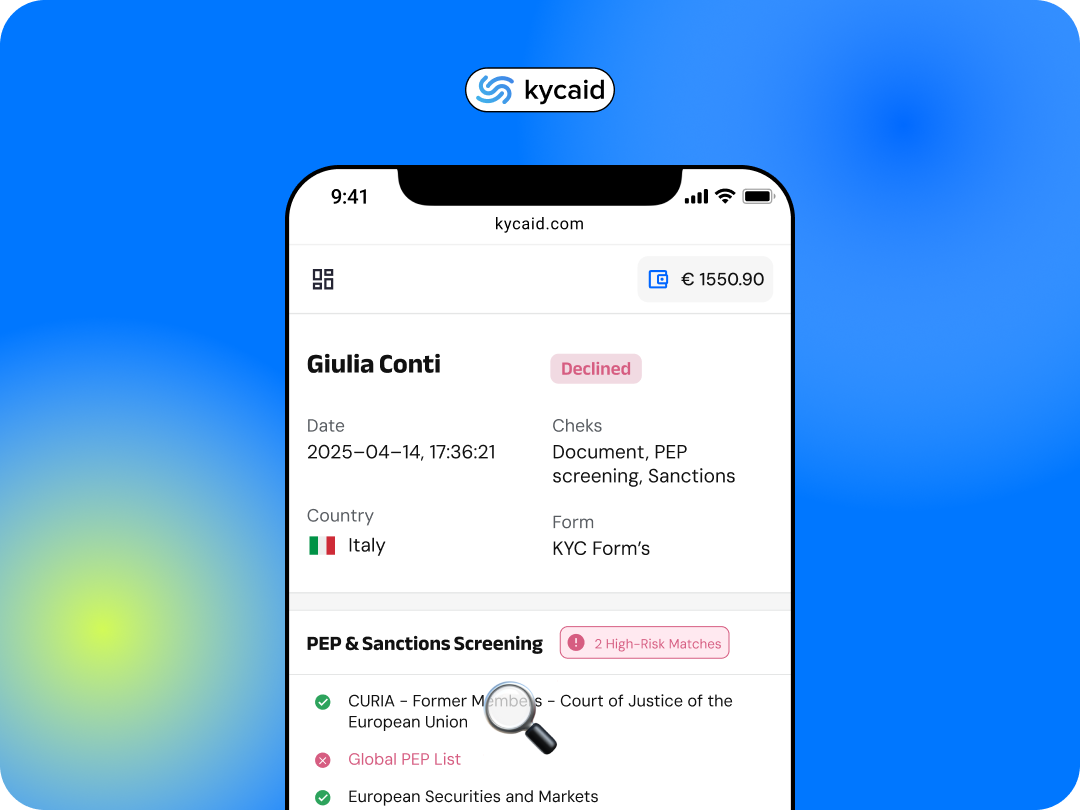

Real-Time Global PEP and Sanctions List Access

Linking to constantly updated worldwide databases, KYCAID offers instantaneous access to international PEP and sanction lists. This guarantees that companies are screening against the most current and accurate data available, therefore lowering their risk of running across high-risk people.

Artificial Intelligence-Powered Fuzzy Logic and Name Matching

Conventional name-matching methods can overlook subtly changed or purposefully hidden PEP records. Using AI-powered fuzzy logic and machine learning techniques, KYCAID finds possible aliases, close matches, and variants. For compliance teams, our clever matching technique lowers false negatives while still allowing false positives under control.

Automated Risk Scoring and EDD Triggers

KYCAID surpasses basic PEP identification. Based on a user's PEP level, location, and other contextual elements, its automatic algorithm gives dynamic risk scores. Enhanced Due Diligence (EDD) systems are set off automatically when increased risk levels are found, therefore enabling companies to act pro-actively in line with regulatory expectations.

Seamless API Integration for Any Platform

Built with adaptability in mind, KYCAID's API seamlessly connects with a variety of platforms—including custom-built systems, CRMs, and onboarding tools. This lets organisations simplify their compliance processes without interfering with business operations.

PEP screening tools

Strong reporting and monitoring tools offered by KYCAID help companies to keep thorough records of every PEP screening, risk assessment, and decision-making. These audit-ready systems support internal audits, regulatory inspections, and real-time compliance practice monitoring.

Best Practices for Managing PEP Risks

To effectively manage risks associated with Politically Exposed Persons (PEPs), organisations should adopt the following practices:

- Apply a Risk-Based Approach: Recognise that not all PEPs pose the same level of risk. Tailor your due diligence accordingly.

- Document Decisions Thoroughly: Keep detailed records of all decisions, especially those involving overrides or where escalation is not pursued, to demonstrate compliance rationale.

- Provide Staff Training: Ensure compliance teams are well-equipped to identify and manage PEP-related risks.

- Re-Screen Regularly: PEP status can change over time. Schedule periodic re-screenings or trigger them based on specific risk indicators.

KYCAID Solutions for PEP Screening and Monitoring

KYCAID offers tools designed to enhance and streamline the PEP screening process:

- Customisable Database Selection: Choose databases that align with your specific compliance requirements for more focused and efficient screening.

- Multi-Language Name Matching: Advanced algorithms handle name transliterations and script variations, reducing false positives.

- Seamless API Integration: Integrate KYCAID’s screening tools into your existing systems for real-time, automated compliance checks.

- Regulatory Reporting Support: Generate reports in line with AML directives, simplifying documentation for each applicant.

- One-Time Screening: Conduct initial checks against all relevant databases during onboarding.

- Ongoing Monitoring: Continuously monitor verified individuals to detect emerging PEP risks.

In Essence, Proactive PEP Screening Protects Your Company

Proactive PEP screening protects your company from financial crime, regulatory fines, and brand damage rather than only ensures compliance. Integrating smart technologies like KYCAID helps businesses to keep a solid AML posture and lower manual workload.

Without careful PEP identification and suitable risk-based responses, KYC is not complete. Allow KYCAID to guide you towards continued compliance, audit-ready confidence in your customer due diligence procedures.