Effortless KYC Solutions

for Brazil

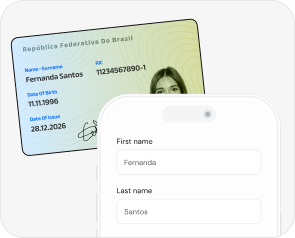

Unlock the fastest and most reliable KYC services in Brazil with Kycaid. Swift and easy CPF & CNPJ number validation with the government database will streamline onboarding and enhance security.

Comprehensive Verification

Our suite of tools empowers you to verify and onboard new users promptly. From the National Identity Card (Cédula de Identidade) to passports, driving licenses, and credit/debit cards, Kycaid meticulously authenticates each document, leaving no room for error.

Kycaid's innovative solutions offer a robust framework for identity verification, business transparency, and the prevention of financial crimes, ensuring a secure and compliant financial ecosystem.

Why Choose Kycaid for KYC in Brazil?

-

Compliance and Efficiency

Kycaid adheres to global and local regulations, including those set by the Council for Financial Activities Control (CVM) and the Council for Financial Activities Control (COAF) for legal compliance.

-

Distinct ID Verification Services

Kycaid simplifies digitization through services such as face detection, CPF document entry, and cross-verification with government databases. Users can swiftly finalize the verification by entering their CPF number, ensuring efficient and instant results.

Aligning with the stringent regulatory requirements of key financial institutions in Brazil.

In compliance with the:

-

Central Bank of Brazil

-

The National Monetary Council (CMN)

-

The Securities and Exchange Commission (CVM)

-

The Council for Financial Activities Control (COAF)

-

-

Advanced Identity System

Our in-house solutions ensure efficient identity verification and precise risk assessment by leveraging advanced AI and data analytics.

Innovative AML&KYC Compliance

-

Global and Local Standards: Aligning with international and local regulations, KYCAID ensures adherence to Anti Money Laundering Directives,FATF standarts, and the General Data Protection Regulation.

-

Transparency Focus: KYCAID addresses the demand for increased clarity, emphasizing compliance with AMLD 4, especially regarding beneficial ownership.

-

Electronic Identification Integration: The platform seamlessly incorporates electronic identification means in line with AMLD 5 under the eIDAS Regulation .