KYC & AML for Crypto Users

Simplify crypto operations with KYCAID: Seamless KYC verification for enhanced security. Accelerate onboarding, build trust, and ensure compliance effortlessly!

KYC & AML for Cryptocurrency Use

The ultimate goal of KYC is to keep everything transparent and spot illegal actions, such as financial fraud or money laundering attempts. Extensively implemented blockchain networks enable decentralised crypto transactions that can be absolutely anonymous. A common abuse of this ability by users is the main reason to adopt proper crypto verification and achieve full KYC compliance.

Going for KYC compliance is a win-win effort. You get to comply with common global standards and reinforce the overall security of crypto transactions that you carry out through a range of KYC and AML procedures.

Enhance Your Crypto Security

Explore the efficiency of KYCAID's instant identity verification services to maintain compliance effortlessly and mitigate risks effectively.

Ongoing monitoring

Ongoing monitoring is vital for crypto businesses to maintain compliance and mitigate risks effectively. Our routine checks for document expiration and AML databases ensure up-to-date compliance and immediate detection of any anomalies or suspicious activities. This vigilance helps maintain a secure environment, flagging high-risk customers and irregular patterns for a thorough review.

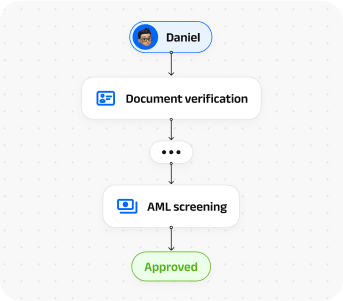

AML Screening

When it comes to efficient KYC, crypto exchanges must also make sure that they do not deal with customers that may be subject to local or international sanctions, have any “eye-grabbing” criminal record, or are politically exposed persons of some sort. These are the main categories of users prone to money laundering.

Identity Check

Document and liveness check combo ensures a secure and compliant environment, validating user identities and preventing fraudulent activities within the crypto space. They establish trust and credibility while safeguarding against unauthorised access or misuse of accounts.

In terms of the major efforts to implement to comply with KYC, VASPs should carry out reliable identity verification. This includes thorough collection and verification of a customer’s name, date of birth, private or corporate address, and any related business information.

Enhanced Security in Crypto Operations with KYCAID

KYCAID transforms crypto interactions with cutting-edge KYC solutions. Our platform ensures seamless onboarding, robust security, and regulatory compliance. Empower your users with a frictionless experience while safeguarding your business against risks.

Onboard new customers faster

A reliable KYC/AML solution can help you facilitate and smooth out the verification process to make the initial onboarding convenient and rapid for all new customers. This gives you a great competitive advantage user experience-wise.

Data security guarantee

With our solutions, your business is fully GDPR- and CCPA-compliant. We help properly comply with security standards and store PII securely in the system. You are not responsible for potential data leakage, but you have easy and reliable access to them at any time.

Conversion boost

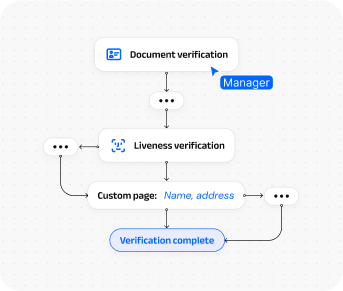

The platform's user interface is designed to make the process of checking compliance standards a breeze. Using our intelligent platform infrastructure, you will be able to create custom workflows and employ various methods for checking compliance with KYC rules. This will double your conversion rates over time!

Make multiple verifications flows

Specialised KYC/AML solutions from our service can help you create multiple verification flows based on different check criteria, user categories, and risk segments. This is the ultimate way to personalise user journeys in terms of your exchange and accelerate user pass-through rates.

Try our solutions

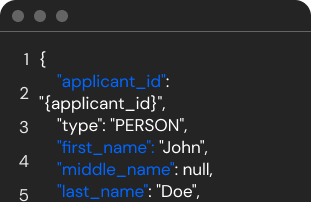

KYC API Integration For Crypto & Blockchain

Our advanced API offers swift and easy integration, ensuring secure and efficient identity verification within your crypto and blockchain platforms, enhancing user trust and regulatory adherence.