Secure Retail & E-commerce Identity Verification

Efficiently onboard sellers globally, and elevate customer trust with rapid identity verification tailored for e-commerce ecosystems.

Frictionless E-commerce journey with Kycaid

Secure your clients' and partners' identities against e-commerce fraud and identity theft. Gain insights into protecting personal information and preventing unauthorized purchases.

Take control of your e-commerce security today with KYCAID's advanced fraud prevention solutions.

Safeguard Your Business with Kycaid Solutions

Efficient Verification and Compliance Services

Combat cart abandonment, payment fraud, and credit card scams with Kycaid Solutions. Boost your profits and customer trust with our comprehensive fraud prevention and identity verification services.

-

Engage Effectively

Seamless omnichannel experiences

Expedited order fulfillment

Robust cybersecurity

Increased conversion rates

-

Prevent Fraudulent Activities

Real-time fraud detection

Secure user authentication

Data protection

-

Counter Credit Card Fraud

Secure user verification

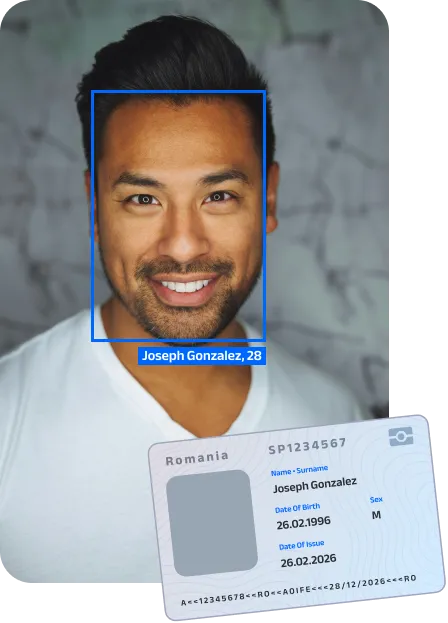

Liveness detection

Automated fraud checks

-

Secure Your Partnerships

Verify entity legitimacy

Ensure safe collaborations

By implementing ID verification, Liveness, Payment Method, Address, Database screening, and Non-doc verification services, businesses can mitigate payment fraud risks, counter credit card fraud, and safeguard transactions by ensuring the legitimacy of customers and partners.

Don't let fraud hinder your success.

- ID verification

- Liveness

- Payment method

- Address

- Database Screening

- Non-doc

businesses can mitigate payment fraud risks, counter credit card fraud, and safeguard transactions by ensuring the legitimacy of customers and partners. Don't let fraud hinder your success.

Ensure Safe Purchases with Ease

-

Initiation: Applicants submit ID documents, photos of the credit card, and bank statements for cards without the cardholder’s name.

-

Liveness check: Users go through passive or active liveness checks to confirm they are real people.

-

Automated Cross-Check: Verify alignment of payment method details with ID document data.

-

Manual Review: The compliance manager conducts a thorough review for up to 5 minutes.

-

Outcome Notification: Applicants are verified successfully and can proceed to further shopping.