Brazil's gambling landscape is undergoing a significant transformation, propelled by recent legislative efforts aimed at establishing a more effective regulatory framework. The government's commitment to addressing various forms of gambling, particularly sports betting and online gaming, is reshaping the industry to enhance consumer protection, ensure fairness, and generate much-needed tax revenue.

The Legal Framework for Gambling

The legal structure governing gambling in Brazil is primarily anchored in the Criminal Contravention Act (Decree-Law No. 3,688/1941), known as the MCA, along with subsequent legislation such as Law No. 13,756/2018, which laid the groundwork for modern gambling practices. The most recent amendment, Law No. 14,183/2021, updated Article 30, imposing financial obligations on both land-based and online gambling activities, ensuring contributions to social security. Furthermore, Provisional Measure 1,182/2023 has introduced specific regulations for sports betting, establishing tax frameworks and responsible gambling practices.

In Brazil, several forms of gambling are legally recognised, including:

Despite these advancements, some areas, such as online casinos and certain skill-based games, remain unregulated. The Brazilian government acknowledges the urgent need for further regulation to combat illegal gambling, safeguard consumers, and bolster tax revenue.

The Rise of Sports Betting Regulations

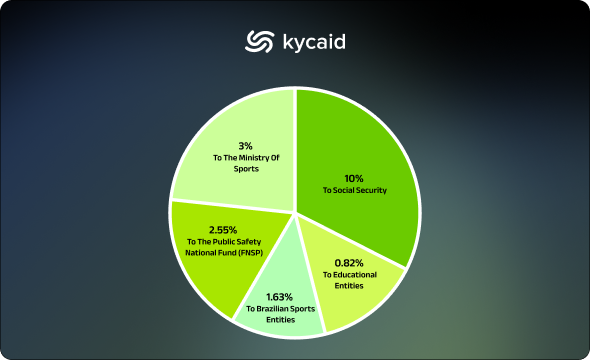

Sports betting is now governed by a defined taxation regime. The Gross Gaming Revenue (GGR), representing the revenue operators earn after deducting prize payouts and applicable income tax on winnings serves as the taxation basis. Key contributions from GGR include:

Moreover, foreign operators must establish a local presence to offer services in Brazil and adhere to advertising and sponsorship restrictions. As Brazil navigates the complexities of sports betting regulation, ongoing investigations into match-fixing by the Parliamentary Commission of Inquiry (CPI) underscore the importance of compliance and integrity within the gambling industry.

Anti-Money Laundering (AML) Legislation

The foundation of Brazil's anti-money laundering (AML) legislation is laid out in Law No. 9,613/1998, as amended by Law No. 12,683/2012. These laws, enforced by the Financial Activities Control Council (COAF), define money laundering as the act of concealing or misrepresenting property, assets, rights, or values derived from criminal acts. COAF is responsible for investigating and penalising money laundering activities and issuing directives to mitigate risks, including those associated with gambling.

To combat money laundering and terrorist financing, the Ministry of Finance Ordinance GM/MF No. 537/2013 imposes stringent requirements on entities that distribute funds via lotteries. For instance, all prize winners must be identified, with detailed records kept on prize descriptions, amounts, and recipient information.

Suspicious transactions must be reported to COAF, particularly patterns such as:

🔹Unjustified high-volume ticket sales or prize payments in specific areas or over designated time intervals.

🔹Prize payments involving individuals from high-risk jurisdictions as defined by the Financial Action Task Force (FATF) or countries with preferential tax regimes.

🔹Multiple prize payments to the same individual or prize amounts reach the maximum bet limit.

🔹Instances of clients providing false information or resisting verification processes.

Certain transactions must be automatically reported, such as cash prize payments over 10,000 BRL or transactions linked to suspected terrorism. If no suspicious activities are reported within a year, operators must submit a negative certification by 31 January of the following year.

Responsible Gambling Measures

To foster responsible gambling, Brazil mandates that operators implement various protective measures for vulnerable players. These include:

🟢Deposit Limits: Allowing players to set caps on their spending.

🟢Educational Resources: Providing information on responsible gambling practices.

🟢Self-Exclusion Programs: Allowing players to voluntarily restrict their access to gambling activities.

Compliance with these responsible gambling guidelines is crucial for operators to maintain their licences and adhere to Brazilian regulations. KYC (Know Your Customer) processes facilitate this by enabling operators to verify player identities and ensure that only eligible individuals participate in gambling activities.

Poker Regulation and Taxation

Poker enjoys a dedicated following in Brazil, with distinct taxation rules for tournament and ring gameplay. In tournaments, gross revenue is calculated by subtracting the prize pool from entry fees, subjecting operators to taxes like PIS, COFINS, and ISS. For ring games, revenue is based on the rake collected from each hand and is similarly taxed.

In addition to operator obligations, players are subject to progressive income tax on their winnings, with a 30% withholding tax for amounts exceeding 2,112 BRL. These measures ensure accurate tax collection and align with broader compliance goals to mitigate risks such as tax evasion and money laundering.

KYC processes play a vital role in compliance and fraud prevention in poker. By verifying player identities, KYC providers assist operators in maintaining accurate records and adhering to tax obligations, thereby reducing risks associated with tax evasion and money laundering.

Enforcement and Liability

Both operators and players can be liable for non-compliance with Brazilian gambling regulations. Enforcement typically occurs through police operations and judicial intervention, especially in cases where illegal gambling is conducted alongside other criminal activities. Although local gambling debts are generally unenforceable, there are exceptions for debts arising from legal activities like lotteries or horse racing. Furthermore, debts owed to foreign operators can be enforced if properly recognised by the Brazilian Superior Court (STJ).

Potential Reforms and Industry Implications

The Brazilian Congress is actively contemplating further regulations, particularly in light of findings from the CPI investigation into match-fixing. Expected reforms include:

Expected reforms include:

Advertising and Sponsorship Regulations: Strengthening rules around advertising and sponsorship, especially in sports betting.

Increased Taxation: Reviewing tax measures to maximise revenue generation from gambling activities.

Stricter Compliance Guidelines: Implementing enhanced guidelines for operators to ensure adherence to social responsibility and AML requirements.

These anticipated reforms reflect Brazil's ongoing commitment to refining its regulatory framework and addressing emerging challenges within the gambling industry.

Conclusion

Brazil's gambling regulations are evolving rapidly, with the government taking deliberate steps to oversee an industry that has long operated without substantial oversight. With new legislation and ongoing discussions about further reforms, operators and players alike must stay informed and adapt to the changing regulatory environment. As Brazil continues refining its gambling regulation approach, these measures are expected to foster a safer and more accountable gaming landscape, benefiting operators, players, and the broader community.

Stay ahead in Brazil's evolving gambling landscape. Discover how our solutions can help you navigate new regulations with ease and compliance confidence.