The global payments industry is undergoing an extraordinary transformation with the rapid rise of real-time payments (RTP). These systems are revolutionising how businesses, governments, and consumers interact with financial services. As digital payments gain popularity, the importance of secure transactions and robust compliance measures has become even more critical. This is where KYCAID steps in, providing advanced Know Your Customer and Anti-Money Laundering solutions that help payment providers ensure secure, compliant services.

Real-Time Payments: A Growing Global Phenomenon

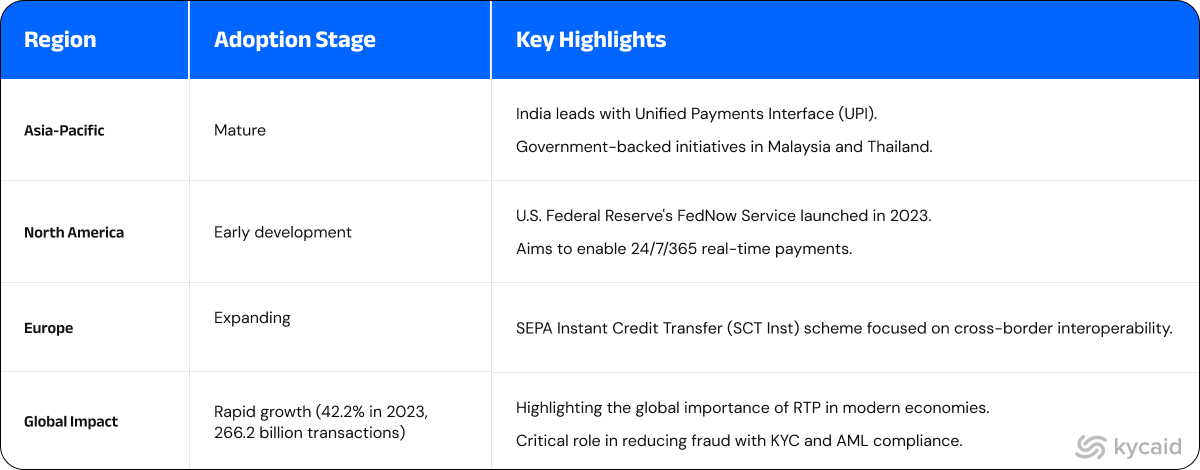

Real-time payment systems are reshaping the financial landscape worldwide. According to ACI Worldwide’s 2024 report, RTP transactions surged by 42.2% in 2023, reaching 266.2 billion transactions globally. This growth highlights the increasing demand for faster, cheaper, and more efficient payment methods. With RTP, transactions are completed in seconds, improving liquidity, reducing transaction costs, and driving financial inclusion, especially in regions where access to traditional banking is limited.

In regions like Asia-Pacific, real-time payments are already well-established. India, for example, has seen significant success with its Unified Payments Interface (UPI), a government-backed initiative that allows instant and low-cost payments. Other countries in the region, such as Malaysia and Thailand, have followed suit with similar government-supported initiatives, further accelerating RTP adoption.

In contrast, North America is still in the early stages of implementing RTP. The U.S. Federal Reserve launched the FedNow Service in 2023, aiming to enable 24/7 real-time payments for businesses and consumers across the country. Europe is also working to expand its RTP capabilities through the SEPA Instant Credit Transfer (SCT Inst) scheme, which focuses on enabling seamless cross-border transactions.

The benefits of RTP are clear:

🔹Businesses benefit from faster cash flow, lower operational costs, and greater efficiency.

🔹Governments use RTP systems for faster benefit distribution and tax refunds.

🔹For consumers, RTP means instant access to funds, making it easier to manage finances and increasing financial inclusion globally.

However, with these benefits come new challenges, particularly in ensuring the security and compliance of these systems.

The Need for Robust Compliance in the RTP Era

As real-time payments become more widely adopted, the risk of fraud grows. Scammers have become increasingly sophisticated, making it essential for payment providers to implement strong fraud prevention measures. This is where compliance solutions like KYC and AML are crucial.

KYCAID provides a comprehensive KYC and AML solution tailored to the needs of payment providers. By integrating KYCAID’s tools, payment companies can verify users’ identities in real time, ensuring compliance with global regulations and reducing the risk of fraud. These solutions not only help businesses comply with legal requirements but also build trust with consumers, who increasingly demand transparency and security in digital transactions.

The Economic Impact and Growing Consumer Protection

The economic benefits of RTP are significant. According to McKinsey & Company’s "2023 Global Payments Report," the global payments industry reached a record $2.2 trillion in revenue in 2022, an 11% increase from the previous year. The growth can be attributed to two main factors: the rise in electronic transactions and higher interest rates. As cash usage continues to decline, more consumers and businesses are turning to digital and contactless payment methods.

As the digital payment landscape evolves, so does the need for enhanced consumer protection. One growing concern is “authorised fraud,” where scammers trick individuals into authorising payments under false pretences. To combat this, the U.S. has proposed the "Protecting Consumers from Payment Scams Act," which aims to strengthen consumer protections and hold financial institutions accountable for fraud prevention.

The proposed changes to the Electronic Fund Transfer Act (EFTA) include expanding the definition of unauthorised transactions to cover fraudulently authorised payments and creating shared liability to encourage vigilance across the payment chain. The act also aims to improve error resolution, making it easier for consumers to recover lost funds in cases of fraud.

For payment providers, these changes represent both a challenge and an opportunity. To comply with new regulations and protect their customers, financial institutions must adopt advanced fraud detection technologies, enhance staff training, and educate consumers on how to identify scams. KYCAID’s KYC and AML solutions play a vital role in these efforts, ensuring that only legitimate customers have access to payment systems while preventing fraud before it happens.

Ensuring Global Compliance and Security

While RTP systems are expanding rapidly, achieving global interoperability remains a challenge. Payment systems often operate within regional silos, which can make cross-border real-time transactions difficult. To address this issue, governments, regulators, and industry players must collaborate to create universal standards and ensure seamless payment experiences across borders.

Emerging technologies, such as blockchain and artificial intelligence (AI), hold great promise for solving these challenges. Blockchain could streamline cross-border transactions, reducing the cost and complexity of international payments. AI, on the other hand, could enhance fraud detection, improve customer experiences, and increase the efficiency of payment systems.

For payment providers, adopting these technologies is essential to staying ahead of the competition and ensuring security. At the same time, robust compliance practices must remain a top priority. Payment providers need solutions that help them meet global regulatory standards while protecting consumers from fraud.

The Role of KYCAID in the Future of Payments

As the payment industry continues to evolve, the role of compliance solutions like KYCAID becomes even more critical. By offering advanced KYC and AML services, KYCAID helps payment providers navigate the complex regulatory landscape and ensure secure transactions. The company’s solutions enable payment providers to verify the identities of their customers in real-time, helping to prevent fraud, money laundering, and other financial crimes.

In addition to providing essential compliance tools, KYCAID’s services build trust with consumers, who demand a secure and transparent digital payment experience. With the rise of RTP and other digital payment systems, securing customer information and preventing fraud is more important than ever.

As real-time payments continue to reshape the global financial ecosystem, payment providers must adopt comprehensive compliance solutions to stay secure and compliant. With KYCAID’s help, businesses can protect themselves from fraud, comply with global regulations, and build long-lasting trust with their customers. In doing so, they will be better positioned to succeed in the rapidly evolving world of digital payments.