Curaçao, a prominent jurisdiction in the online casino world, has introduced updated measures to tackle money laundering (ML), terrorism financing (TF), and the proliferation of weapons of mass destruction. These regulations were issued on May 15, 2024, marking a significant step towards aligning with global standards and ensuring a secure gaming environment.

According to the regulations, casinos must avoid anonymous or fictitious accounts. They must identify all players and gather information to understand the purpose and nature of their business relationships. Without this information, casinos cannot establish or maintain relationships or conduct transactions. This requirement ensures effective transaction monitoring and detection of suspicious activities. Casinos must implement ongoing monitoring to match transactions with the customer’s risk profile and knowledge of the player. Any unusual transactions or behaviours must be reported to Curaçao's Financial Intelligence Unit (FIU). This will escalate matters to the Public Prosecutor’s Office if links to money laundering or terrorism financing are suspected.

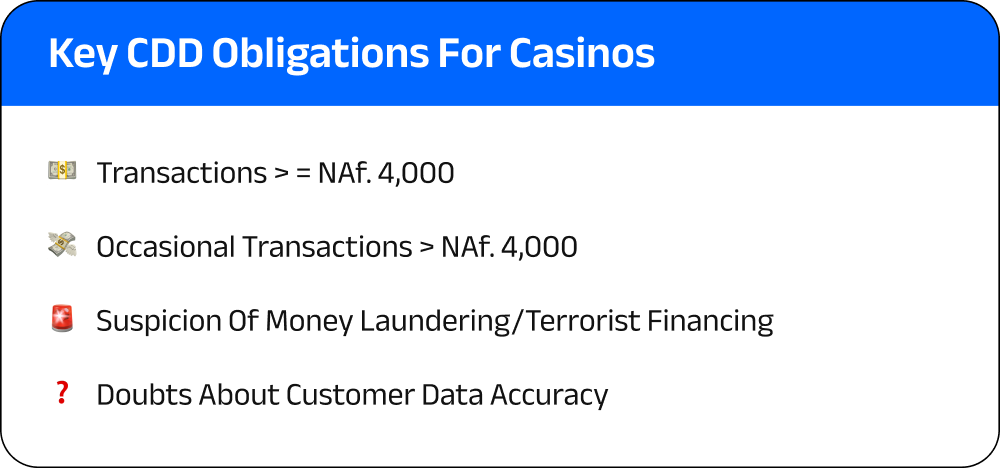

Casinos are mandated to undertake CDD measures in specific situations, such as when players engage in financial transactions equal to or above the monetary equivalent of Naf. 4,000, when there is suspicion of money laundering or terrorism financing, or when there are doubts about the accuracy of previously obtained customer information. The regulations emphasise that a transaction may involve a single transaction or a series of linked transactions, which together exceed the Naf. 4,000 threshold. In such cases, CDD measures must be applied to ensure compliance with the regulations.

When conducting CDD, casinos must identify the player, verify their identity, and assess the risk profile of the customer. This process involves collecting personal details such as full name, permanent residential address, date of birth, nationality, and identity number. Verification of identity typically involves checking reliable, independent source documents, such as government-issued identification, to confirm the player's identity.

Verification of identity refers to actions taken to verify that a person exists and is who he claims to be. This is done by checking reliable, independent (of the person whose identity is being verified) sources.

As a rule, verification of identity has to be carried out by referring to an unexpired government-issued document containing photographic evidence of the customer’s identity (e.g. passport, identity card). Where such a document does not allow verification of the player’s residential address, the casino can obtain other documents like a bank statement, utility bill, letter from a public authority or rental agreement, which should not be more than six months old to verify the residential address. The casino can also contact the player by letter, e-mail or telephone to verify the information supplied. It can also send a verification code to the e-mail address to verify that the address is current and genuine. Verification can also be done by checking social media, telephone directories, company registries or media and news sources. Biometric checks can also be used to confirm that the individual providing the document is the one described therein.

There are also circumstances in which the casino can cross-reference the information in its possession with geo-location information, IP address data, funding method data etc.

Verification is carried out for the casino to determine to its satisfaction that the player is who he declared himself to be. What is important is that documents are clear, legible and of good quality.

Verification of evidence of identity implies a check on whether the document presented is legitimate and that it has not been stolen from the true owner.

Enhanced Due Diligence for High-Risk Scenarios

In situations where there is a higher risk of money laundering or terrorism financing, enhanced due diligence (EDD) measures must be applied. This may involve collecting additional identification documents, conducting biometric checks, or verifying the authenticity of foreign documents. The regulations also require casinos to screen all players against international sanctions lists, including those published by the UN and EU, to ensure they are not doing business with individuals or entities subject to international sanctions.

For politically exposed persons (PEPs), casinos must take extra precautions, as these individuals are considered high-risk due to their potential involvement in corruption or other illicit activities. PEPs can be identified through internet searches or by consulting databases and reports on corruption risks.

All-in-one compliance services

Keep your business compliant and secure with KYCAID’s comprehensive KYC solutions, offering advanced database screening and monitoring to navigate sanctions and manage PEP risks.

As of May 15, 2024, new regulations for combating money laundering, the financing of terrorism, and the proliferation of weapons of mass destruction have become applicable to both land-based and online casinos in Curaçao. A transitional period of three months has been established, requiring all casinos to comply with the new regulations by September 1, 2024. Non-compliance with these regulations can result in severe administrative and criminal sanctions, underscoring the seriousness with which Curaçao authorities are approaching AML/CFT enforcement.

Preventing Tipping-Off and Ensuring Compliance

One of the critical challenges casinos face is avoiding the risk of tipping off customers during the CDD process. Tipping off occurs when a customer becomes aware that they are under scrutiny, which can compromise ongoing investigations. To mitigate this risk, the regulations provide that if a casino suspects that continuing with the CDD process might alert the player, it may choose to halt the process and file an Unusual Transaction Report (UTR) with the FIU.

Casinos are also responsible for ensuring that any physical establishments they use to extend their customer base comply with the casino's AML/CFT policies. This includes identifying and verifying the operators of these establishments and monitoring activities conducted through their accounts. Such measures are essential to prevent any loopholes that could be exploited by criminals.

The new regulations for combating money laundering, the financing of terrorism, and the proliferation of weapons of mass destruction in Curaçao's casino industry represent a robust framework designed to protect the integrity of the global financial system. By adhering to these regulations, casinos play a crucial role in preventing financial crimes and ensuring they are not exploited by criminal elements. The rigorous implementation of Customer Due Diligence, Enhanced Due Diligence, and ongoing monitoring measures underscores the importance of proactive compliance in maintaining a secure and transparent gambling environment. As these regulations take full effect, Curaçao's casinos will be better equipped to safeguard against the risks associated with money laundering and terrorism financing, contributing to a safer and more secure global financial landscape.