Effortless KYC

Solutions for India

Seamlessly onboard users and enhance security with swift Aadhaar number validation against the official government database. Experience a hassle-free two-step verification process

In-depth Verification

Our set of tools enables you to authenticate and onboard new users swiftly. Whether it's an Aadhaar number, passports, driving licenses, or credit/debit cards, Kycaid easily verifies each document, ensuring precision and removing all possibilities of error.

Kycaid's innovative solutions offer a robust framework for identity verification, business transparency, and the prevention of financial crimes, ensuring a secure and compliant financial ecosystem.

Why Choose Kycaid for KYC?

-

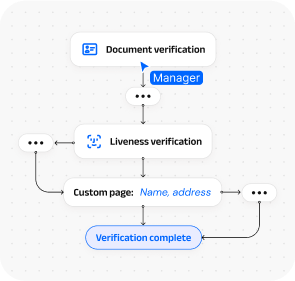

Customizable verification flow

Set up the automated rules, restrictions, and unique branding and tailor the process to your needs.

-

Responsive 24/7 customer support

Our support specialists are always available for our clients with a maximum response time of 15 minutes of SLA.

-

Effortless 2-step user onboarding

Smooth instant verifications reduce drop-off by 30% on average.

-

Regulatory compliance guarantee

Kycaid aligns with global and local regulations, adhering to standards like CVM and COAF for legal compliance in India.

-

Painless integration

Choose what works best for your project - API, Web SDK, or Mobile SDK.

Advanced AML & KYC Compliance

-

Global and Local Standards: Following international and local regulations, KYCAID guarantees compliance with Anti Money Laundering Directives, FATF standards, and the General Data Protection Regulation.

-

Clarity Emphasis: Following international and local regulations, KYCAID guarantees compliance with Anti Money Laundering Directives, FATF standards, and the General Data Protection Regulation.

-

Integration of Electronic Identification: The platform seamlessly incorporates electronic identification methods in compliance with the Prevention of Money Laundering Act, 2002 (PMLA), which serves as the cornerstone of India's legal framework to combat money laundering. PMLA and the Rules notified thereunder came into effect on July 1, 2005.