KYC & AML Compliance for the Real Estate Sector

Real Estate agents must take the necessary steps to ensure that they are protected and compliant with KYC and AML compliance regulations. KYCAID helps to onboard legitimate customers, strengthen ongoing monitoring and secure your business from hefty fines.

AML Checks for the Real Estate Sector

Identifying Beneficial Ownership

KYC confirms beneficial ownership, curbing the use of shell companies to conceal property owners, and enhancing transparency in real estate transactions.

Money Laundering Threats

Real estate deals are often targeted for laundering illegal money. Through validating fund sources and their credibility, KYC significantly hampers undetected money laundering schemes in real estate.

Improving Due Diligence Practices

KYC aids in evaluating the reliability of all involved parties, reviewing their financial background and identifying any legal matters that could impact the transaction.

Regulatory Compliance

Real estate transactions face money laundering risks. AML checks aid agents in adhering to global and local regulations, ensuring client identity verification, and reporting any suspicious transactions promptly.

Protecting Reputation

Real estate professionals need to maintain a trustworthy reputation. Being associated with money laundering activities can harm an agent's reputation and business. AML checks help protect the integrity of the real estate industry and individual professionals

Real Estate as a target for fraudsters

The real estate industry is a target for money launderers since buying & selling property enhances the flow of dirty money. Buying property via complex illicit systems of foreign companies facilitates money laundering. Also, this area deals with large financial transactions that hide information about the owners and their sources of income. Some transactions may involve third parties of doubtful reputation.

A real estate agent should follow the specific compliance requirements, as KYC for estate agents, know your buyer and establish beneficial owner due diligence.

Real estate money laundering red flags

Cash Transactions

Shell Companies

Rapid Resale at a Significant Profit

Unusual Buyer or Seller Behavior

Inconsistent Property Valuations

Lack of Financial Transparency

Use of Nominees or Straw Buyers

Unusual Financing Arrangements

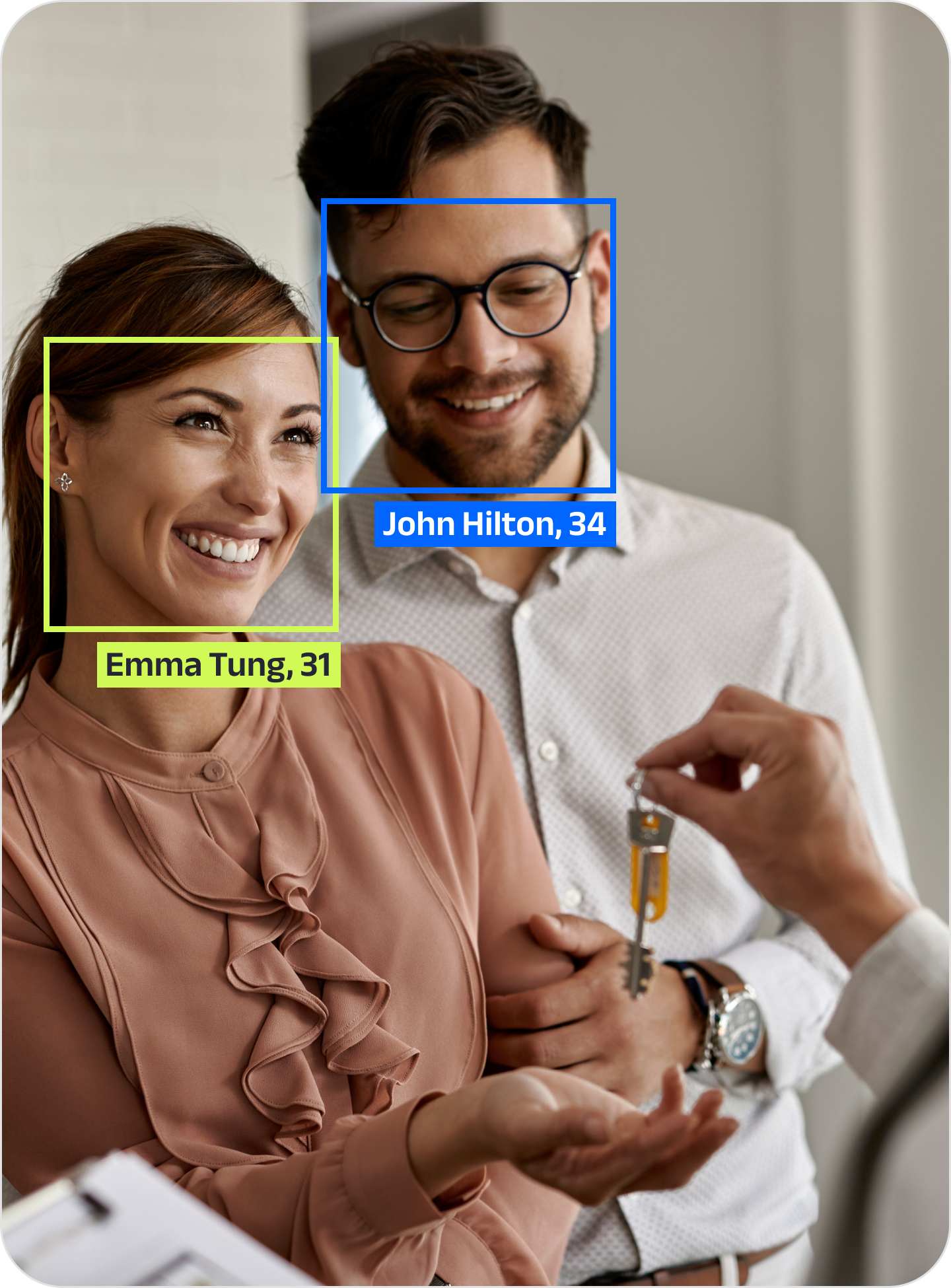

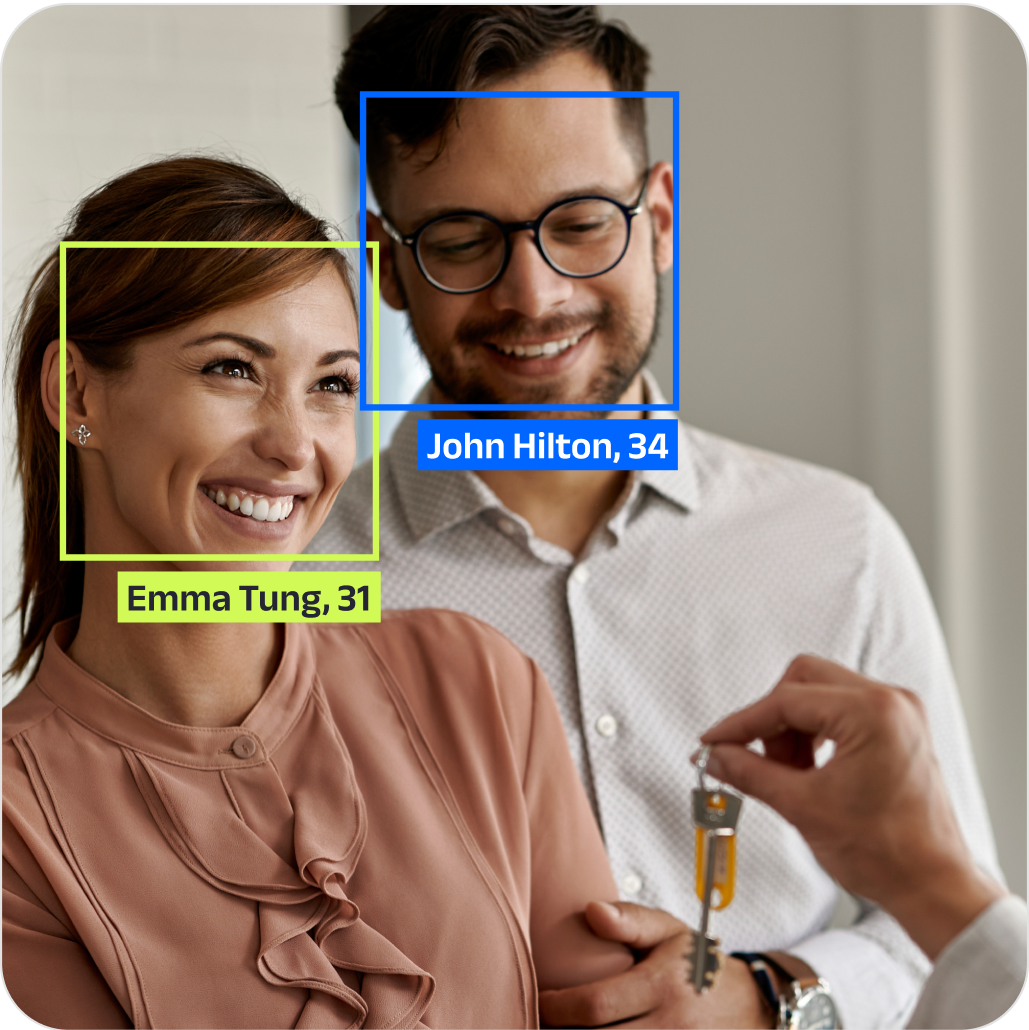

Regular KYC & AML checks for estate agents

Enormous amounts of funds can be cleaned by criminals just in one transaction. That's why it's crucial for real estate agents to check the entire financial operations and report any suspicious activity.

Anti-Money Laundering Software for Estate Agents

From APIs and mobile SDKs for easy system integration to a simple, user-friendly platform, KYCAID offers options to fit your needs. Get in touch to learn more.

| 1 | |

| 2 | "applicant_id": 'applicant_id', |

| 3 | "type": "PERSON", |

| 4 | "first_name": "John", |

| 5 | "middle_name": null, |

| 6 | "last_name": "Doe", |

| 7 | "dob": "1970-10-25", |

| 8 | "residence_country": "GB", |

| 9 | "gender": null, |

| 10 | "email": "[email protected]", |

| 11 | "phone": null, |

| 12 | "pep": null, |

| 13 | "profile_status": false, |