KYC & AML for Easy User Onboarding

Easily onboard more clients with fast and easy KYC & AML solutions. Get to know your new customers 360° while minimising manual tasks for your compliance team and follow all regulations.

Holistic solutions tailored for every industry

-

Fintech

-

Crypto & Blockchain

-

Gambling

-

E-commerce & Retail

-

Healthcare

-

Insurance

-

Gaming

-

Real Estate

-

Legal

-

Age-restricted Products

-

11-sec

average verification speed

-

34%

average cost reduction

-

73%

less manual workload

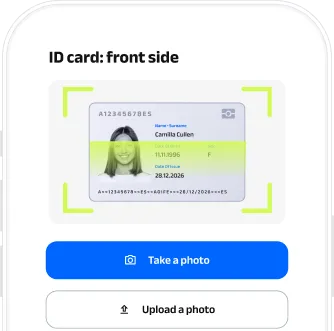

Quick and Easy Verification Flow

Swift document pre-processing, user-friendly guidance, and non-document verification options ensure successful and easy identity verification on the first try. Automate customer onboarding to reduce the risk of losing applicants.

-

1 step

Document Check

-

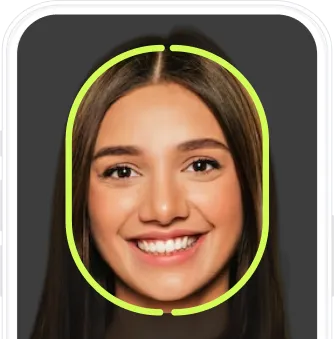

2 step

Biometric Check

-

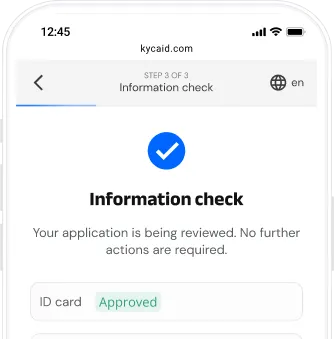

3 step

User is verified

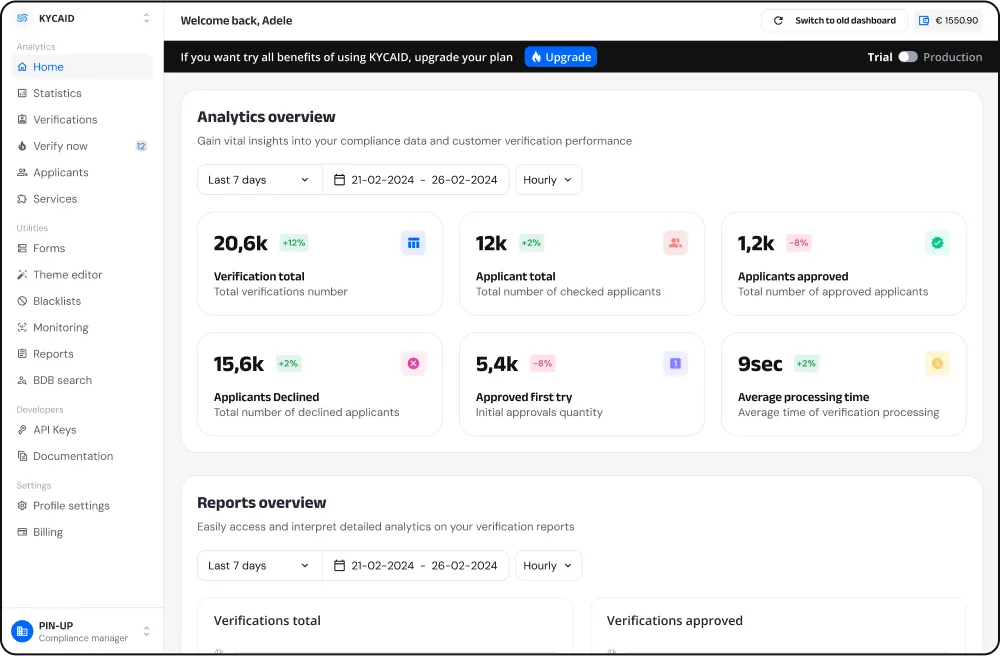

User-friendly KYC for Onboarding

Effortlessly retrieve customer data, monitor client verification status, and get comprehensive analytics within one place.

Fully Personalised KYC Experience

Tailor the workflow effortlessly by adding or removing verification steps based on your current needs.

🔥 It`s so easy

Painless Integration

Select the option that suits your needs best - whether it's through API integration, using our no-code solution, or incorporating our mobile SDK into your application.

🔥 All in one

KYCAID’s Platform

The forward-thinking KYCAID’s approach promotes flexibility by inviting customers to integrate additional fraud prevention services seamlessly with our fundamental ID verification process. Our array of additional services is continuously expanding and presently encompasses